Clinical trial failures are one of the harshest realities of R&D in pharma — and the impact of a trial flop can be far reaching. Some send a company’s fortunes into a nose dive, while others impact the wider industry pipeline for certain indications — perhaps most of all, trial failures can be heartbreaking for patients.

In many ways, the impact of a drug failure cuts the deepest when it’s in the later stages of clinical development and closer to the finish line. Although attrition rates are lower toward the end than in the beginning of development, no drug is safe even in phase 3.

An assessment of 640 trials published by Contemporary Clinical Trials Communications found that 54% of novel therapeutics faltered in phase 3 — 57% of which flunked due to inadequate efficacy.

Recent disappointing trial readouts have run the gamut of assets in early- to late-stage development, and were developed to target a range of different diseases. Here’s a look at five of the most impactful trial failures from the last few months.

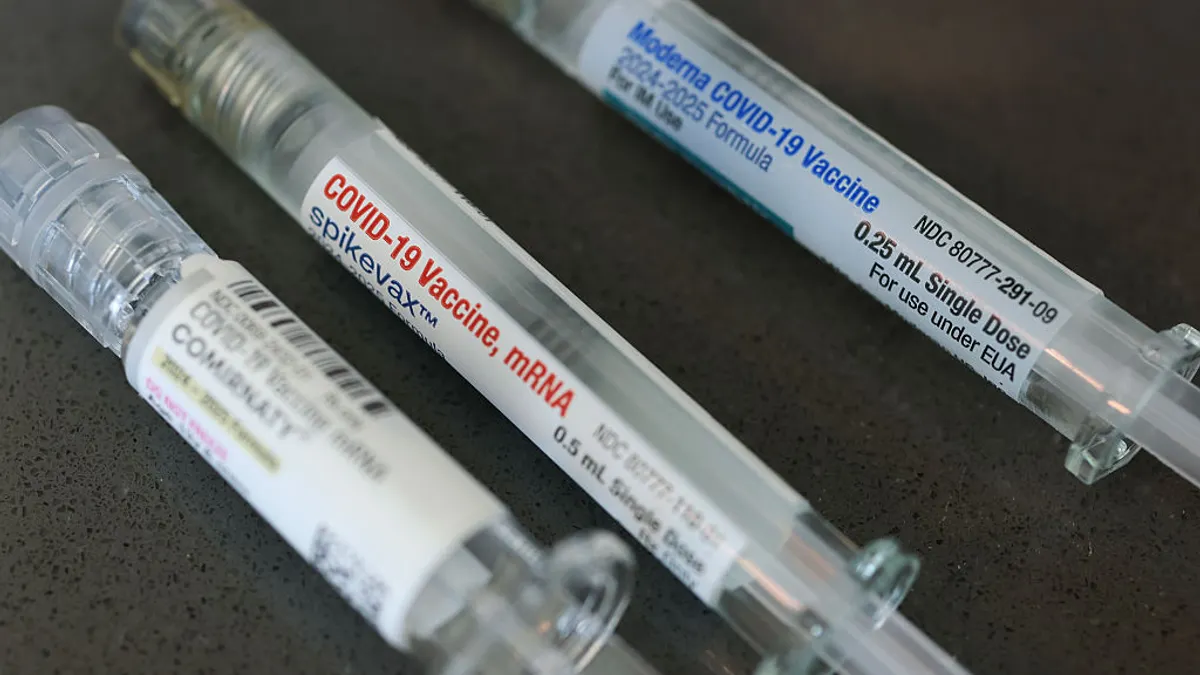

AstraZeneca/University of Oxford add to vaccine woes with poor trial results from their nasal spray

Developer: AstraZeneca/University of Oxford

Drug: Nasal version of COVID-19 vaccine based on ChAdOx1 adenovirus vector

Why it matters: Drug developers have been actively hunting for next-generation versions of COVID-19 vaccines to overcome some of the limitations with the shots — and nasal sprays are an attractive target. Not only does the nasal route allow the immune system to attack the virus at a frequent point of entry, the sprays could also be a simpler way to achieve widespread rollout on a global scale.

At least 12 nasal spray versions of COVID-19 vaccines are in preclinical through late-stage development, including four candidates in phase 3 testing. Several of these studies have reported positive results and two have won regulatory approval — one in China and the other in India.

But the field suffered a setback this month when AstraZeneca and the University of Oxford reported that its nasal spray version of the company’s ChAdOx1 adenovirus vector vaccine “did not generate a consistent mucosal antibody nor a strong systemic immune response” in a small phase 1 trial.

According to the researchers, the study is thought to be the first with published data on an adenovirus vector vaccine using a “simple nasal spray,” which the researchers said would be easier to administer than China’s approved spray that requires a complex nebulizer device.

The news is the latest in a series of struggles for AstraZeneca and the University of Oxford on the COVID-19 vaccine front. After the rollout of the duo’s shot was beset by supply challenges, reports of rare blood clots linked to the vaccine 24 countries to temporarily stop its use. AstraZeneca still made $4 billion on COVID products in 2021, but the company predicts that its 2022 sales will fall by at least 20%. Any hopes of the nasal spray version revitalizing its position in the market now appear in jeopardy.

Of course, work in the industry on nasal sprays using other types of technologies is carrying on. New York-based Codagenix has one of the most advanced nasal spray candidates in trials the company believes could score an approval as soon as next year.

Despite a big win for ALS patients, recent failures signal ongoing difficulties in the space

Developer: Biohaven

Drug: Verdiperstat

Why it matters: On Sept. 29, Amylyx Pharmaceuticals made headlines with word from the FDA that its ALS drug had been given the green light. Partially funded by the online “Ice Bucket Challenge” that went viral in 2014, Amylyx’s drug is the first to get an FDA OK for the disease since 2017 and just the third approved for ALS overall.

But on the same day, the ALS community was hit with disappointing news from Biohaven that its drug called verdiperstat had failed a phase 3 trial for the condition. Licensed from AstraZeneca in 2018, verdiperstat was being studied at Massachusetts General Hospital with multiple experimental ALS medicines. Ultimately, the drug failed to move the needle on disease progression or survival compared to a placebo.

In May, Biohaven notched a major deal with Pfizer who bought the biotech’s migraine business for $11.6 billion. Since then, the company has reported two negative readouts, including the verdiperstat results. Biohaven hasn’t disclosed if it will continue developing verdiperstat for any other indications, but it now has just one phase 3 hopeful in the works — an OCD treatment it plans to report data on later this year.

Just days after the Biohaven news, Clene Nanomedicine also reported that its ALS drug failed to hit primary and secondary endpoints in a phase 2 trial, again reinforcing the challenges of researching treatments for the fatal disease. The company is now seeking strategic partners for the asset and pushing ahead with other trials testing the drug at a different dose.

Lung cancer failure could dash Novartis’ blockbuster aims for repurposed drug

Developer: Novartis

Drug: Canakinumab

Why it matters: Novartis has big goals in oncology to develop treatments that can prevent cancer from forming in high-risk individuals. Particularly, the company has focused on developing immune-targeting drugs that regulate inflammation, which it believes could be the “next frontier” in treating cancer.

However, its efforts around repurposing an anti-inflammatory rare disease drug called canakinumab in cancer have come up short. In August, the company reported that canakinumab flunked its third trial for non-small cell lung cancer (NSCLC), which was most recently being tested as a way to prevent the return of tumors after surgery. It was the third phase 3 trial failure for canakinumab, which is approved for several periodic fever conditions and a rare form of arthritis.

Novartis had already failed to sway the FDA into an expanded approval for the drug in 2018 as a preventative treatment for certain heart conditions, and now its efforts to broaden the treatment’s use in NSCLC seem to have hit a dead end. Jefferies 'analyst had predicted that an expanded approval could lift sales for canakinumab to $2 billion.

The company has another trial for the drug underway in lung cancer and an oncology expert recently told Bloomberg that the anti-inflammatory properties of canakinumab could still make it a “nice model” for cancer prevention for the right patient population.

Intercept stumbles on quest for long sought-after NASH approval

Developer: Intercept Pharmaceuticals

Drug: Ocaliva

Why it matters: Considered a “drug development graveyard,” nonalcoholic steatohepatitis (NASH) has long stymied researchers — and motivated a race to develop the first-ever approved treatment for the indication, which has an estimated value of $35 billion.

A metabolic disease often stemmed from obesity (rather than alcohol intake), NASH can trigger scarring, cirrhosis and even failure in the liver.

Intercept Pharmaceuticals' obeticholic acid drug Ocaliva — already approved for biliary cirrhosis — has been in trials for several NASH-related indications and is being closely watched as a potential first-ever winner in the space. For over a year, the company has been in talks with the FDA about advancing Ocaliva toward an approval for patients with liver fibrosis due to NASH. Now, a recent trial failure for a different but related indication — patients with compensated cirrhosis due to NASH — could complicate the treatment’s path forward.

"Achieving statistical significance on a histology endpoint in compensated cirrhosis due to NASH has proven to be an extremely high bar in clinical trials."

M. Michelle Berrey

President of R&D, chief medical officer, Intercept

On Sept. 30, Intercept announced that Ocaliva failed to meet its primary endpoint in the failed study called Reverse. In a statement, the company said the results would not impact its planned NDA for Ocaliva for liver fibrosis, which is supported by positive phase 3 data. But it’s unclear if the agency will agree. Intercept plans to submit its NDA by the end of this year.

Several other major players — including Novo Nordisk, Alnylam and its partner Regeneron, and Akero Therapeutics — also have NASH candidates coming down the pipes.

A new option for fast-acting depression relief suffers setback

Developer: Relmada Therapeutics

Drug: REL-1017

Why it matters: After decades of stagnation, the field for new depression drugs has been reinvigorated in recent years psychedelics-based R&D and two new products — J&J’s ketamine spray Spravato and Axsome Therapeutics’ Auvelity, which became the first fast-acting oral drug for major depressive disorder approved in August.

Relmada Therapeutics has also been targeting the indication with REL-1017, which the company says targets an NDMA receptor (NDMAR) and blocks “hyperactive NDMAR channels.” If effective, Relmada believes the “novel approach” could provide another option to rapidly treat depression.

It struck out in its first phase 3 trial of the drug, however, which failed to perform better than a placebo at improving depression symptoms after a four-week course, the company announced this month. Relmada blamed a “higher than expected placebo response” and called the results “disappointing.”

The company’s hopes are now pinned on the performance of REL-1017, its only lead asset, in two other phase 3 trials where it’s being tested alongside other depression drugs, and the company indicated that positive results from those studies could be enough to warrant a submission to the FDA. Any failures, however, could spell doom for Relmada, whose only other development program includes “psilocybin and derivatives” licensed through an acquisition. News of the recent trial failure sent its stocks into a free fall of nearly 80%.

Meanwhile, the pipeline for promising new candidates to treat depression remains slim. An analysis from late last year of compounds that have posted positive phase 2 or 3 results for depression revealed just nine hopefuls — demonstrating the ongoing need for successful innovation in the space.