Welcome to today’s Biotech Spotlight, a series featuring companies that are creating breakthrough technologies and products. Today, we’re looking at OliX Pharmaceuticals, which developed cell-penetrating asymmetric RNAi technology.

In focus with: Dong-ki Lee, CEO, OliX Pharmaceuticals

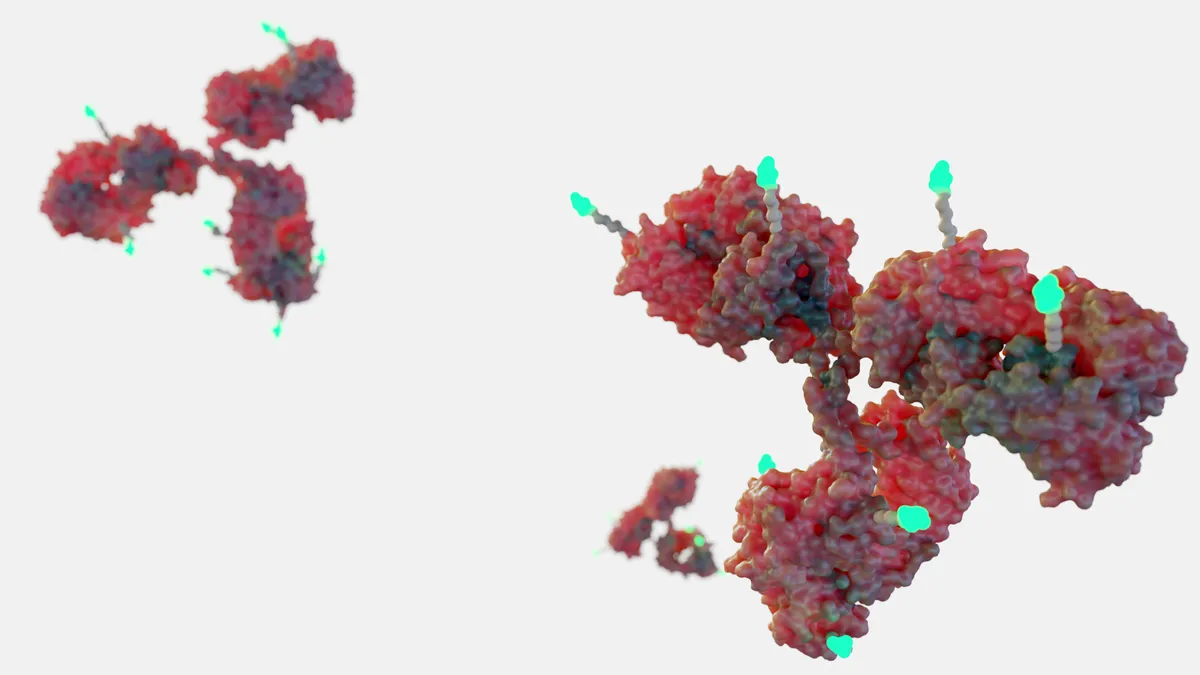

OliX Pharmaceuticals’ breakthrough technology: A clinical-stage company, OliX has developed a proprietary “cell-penetrating asymmetric RNAi technology,” otherwise known as cp-asiRNA, that eliminates side effects caused by RNAi-based therapeutics, including off-target effects and faulty cell delivery. By altering the composition of siRNA and making one strand shorter than the other, OliX’s oligonucleotide-based platform substantially decreases the risk of off-target effects and enables intracellular delivery. While the company believes the technology could be applied to any indication area, it’s concentrating on developing therapies for dermal, liver, ophthalmic and pulmonary diseases.

Why it matters: OliX entered the scene in 2010 at a rocky time for RNAi therapies when many investors and large pharmas were ditching the new technology over concerns of safety risks caused by the off-target effects. But the company’s decision to stay the course could pay off big.

According to Market Data Forecast, the “size of the global RNAi drug delivery market is estimated to be growing at a [compound annual growth rate] of 27.2% from 2022 to 2027.” Overall, the market is expected to be worth $166.8 billion by 2027, triple that of its 2022 value of $50.12 billion.

Currently, OliX averages a market cap of $500 million on the KOSDAQ, the Korean exchange, Lee says, and with the company planning an aggressive development timeline over the next three years, that number is likely to rise.

“I have seen what's been going on in this industry. I saw Enlighten Bio struggling. I saw Arrowhead also struggling, but they really turned back and made a big success based on the targeted RNAi molecule platform. I've been watching these developments and am hoping that we can also follow the same path to be one of the competitive companies,” Lee says.

At a glance: Although OLiX may “look like the new kid on the block,” Lee says the company has a long history. Its therapy to treat hypertrophic scarring, OLX101A, entered phase 2 clinical trials in 2020. No other drugs are approved to treat the condition, which results from an overproduction of collagen in the skin.

Next up in the company’s internal pipeline is a drug for dry age-related macular degeneration (AMD) and one to treat subretinal fibrosis, a form of vision loss.

Lee says his major goal over the next few years is to increase licensing partnerships.

“We are actively seeking partners interested in using our RNAi platform to develop therapeutics against targets of interest. OliX is also actively seeking technologies to license to improve our technology, especially in delivering siRNAs to organs other than the liver,” Lee says. “I understand that everybody is searching for this kind of delivery technology, and we are one of them.”

Here, Lee talks about the rise of the Korean biotech sector, the company’s development plans, strategic priorities for the coming year and more.

PharmaVoice: What are some of your key objectives for 2022?

Dong-ki Lee: So far, we’ve been working on improving our pipelines and platform technologies. We’ve had two global licensing deals so far but, we are really trying to have more programs enter clinical trials. Starting this year, we set a goal to file IND for at least two programs every year until 2025. By 2025, our goal is to have at least 10 programs in clinical trials, and about half of them in phase 2 or further.

That's an aggressive timeline. How are you going to manage all that development growth?

Well, we already have very late-stage preclinical programs so we're going to have our dry AMD ocular programs filing IND this summer followed by the dry AMD and subretinal fibrosis program. We already have two programs ready for this year. Next year, we have at least two liver programs. Science and technology-wise we can achieve it, but we also need personnel and funding to support it. We are raising $88 million in funding within the first half of this year to support our goals. And another reason we set up a U.S. branch is to recruit experts on the development side. We are actively recruiting more people to support our plan.

Where are you finding the talent to manage this pipeline growth?

We set up Olix U.S. in Boston, on the Cambridge side. Boston is a hub of biotech. So, of course, it's very competitive to recruit good people but we were lucky enough to recruit the CMC director who worked at Amgen. We also recently hired a clinical medical director with a great background. We are trying to take advantage of the Boston-based U.S. branch to recruit talent.

When you're working through this development timeline, what is on your mind?

Initially, it's been very difficult because in early 2010 not many investors believed in RNAi technology. They were really not willing to invest. That's why we had a hard time getting funds to carry on our mission. But now, we are in pretty good shape and the Korean biotech sector is booming. We would like to really take this opportunity to catch up and I think we already have. We really believe we could be considered one of the contenders in this very competitive industry. I just hope we can accomplish the goals I've just mentioned and be considered one of the global players soon.

What do you think of some of those market factors that are leading to the boom in the Korean biotech market?

I think the Korean government has been looking for a post-IT industry that could carry on the Korean economy. They selected biotech as one of the future industries and they lowered the bar for startup biotech companies to go public, so investors can make a profit that they can reinvest in new biotechs. Along with global biotech booming up recently, I think it's just a synergy. Right now, the Korean biotech sector is really hot, just tons of money waiting to invest in good companies.

What is the biggest opportunity you want to capitalize on in 2022?

We have a plan for at least two programs going to clinic this year. We also are having several ongoing discussions about global licensing. We would like to accomplish these goals and be successful in our plans for fundraising. We'd like 2022 to be the year OliX goes global and becomes one of the key players in the RNA industry.

Is there anything you want to add that you would like our readers to know about?

Last fall, we signed a licensing deal with Hansoh Pharmaceuticals, one of the top pharmas in China. Since then, we've been getting a lot of calls and contacts from Chinese pharma companies, and we would like to take advantage of this. We would like to take advantage of our geographic location to become a key player in the Chinese territory as well.