Welcome to today’s Biotech Spotlight, a series featuring companies creating breakthrough technologies and products. Today, we’re looking at Mythic Therapeutics, which is aiming to develop more precise ADCs.

In focus with: George Eliades, CEO and president, Mythic Therapeutics

Mythic Therapeutics’ vision: The antibody-drug conjugate market has become one of oncology’s buzziest sectors, with 13 FDA-approved therapies and more than 100 in clinical trials, according to a March review in the journal Molecular Cancer.

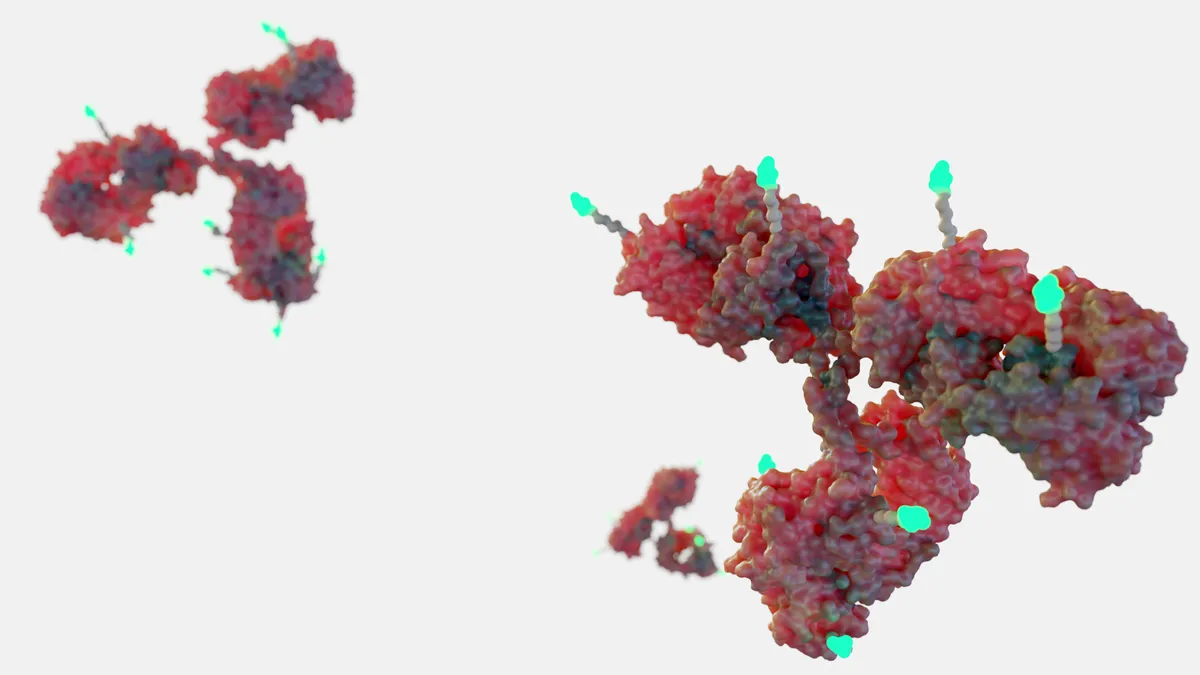

ADCs are a potent type of precision cancer therapy that use a linker protein to combine monoclonal antibodies with an anti-tumor agent “payload,” such as chemotherapy, to deliver cancer-killing medicine to targeted cells. The antibody binds to the cell, the linker degrades and the payload is released.

Traditionally, ADC development has focused mainly on the anti-tumor payload. It’s an approach that makes sense given the payload’s function, Eliades said.

“Linker payload is really important, because ultimately, the cytotoxic payload is what attacks the cancer cells,” he said.

However, the payload dose can end up in normal cells, too, which reduces efficacy and increases side effects. For instance, HER2-targeted ADCs for breast cancer have been associated with cardiotoxicity.

Massachusetts-based Mythic Therapeutics is taking a different approach by developing ADCs that could bind more effectively to the target and more precisely attack cancer cells, resulting in fewer side effects.

“There's this promise for efficacy and for better cancer care overall,” Eliades said. “A better quality of life for the patients.”

How it works: For Mythic, it’s the antibodies that make the difference.

“The antibodies that our team has developed are designed to bind to the cancer cell and stay very tightly bound at a specific pH,” Eliades said. “Inside the endolysosome in the cancer cell, our molecules unbind extremely quickly, which means we get three to five times the internalization of other ADCs.”

Instead of getting the payload near the tumor, Eliades said Mythic’s technology allows more of the treatment to penetrate the tumor.

Why it matters: ADCs have “been around for 20 or 30 years but they've been plagued by one serious problem, which is a very narrow therapeutic index,” Eliades said

Traditionally, only patients who have the highest levels of expression of a cancer target will benefit from ADCs because they have a lot of copies of that target for the ADC to bind to, Eliades said. More precise binding means even patients without high expressions can benefit from ADCs, expanding the patient population.

“Our vision is to bring the transformative benefit of ADCs to more patients,” Eliades said. “Our platform, which we call FateControl, has the chance to do some amazing things.”

Mythic’s leadership team has ADC bonafides, too. The company’s chief development officer Gilles Gallant led a Daiichi Sankyo team in the clinical development, global regulatory submission and worldwide approval of the blockbuster ADC Enhertu. Helen Chalk, vice president of clinical operations, formerly led four ADC programs at Mersana Therapeutics, and Tom Chittenden, senior vice president and head of biology, helped develop the ADC Elahere at ImmunoGen.

In the pipeline: Mythic’s one clinical candidate,MYTX-011, is in a phase 1 study in patients with locally advanced, recurrent or metastatic non-small cell lung cancer.

In a recently published study, a single dose of MYTX-011 showed at least three-fold higher efficacy than a benchmark ADC in mouse xenograft model; showed improved pharmacokinetics; and exhibited a toxicity profile similar to other ADCs with the same cytotoxin.

Eliades said his goal since taking the CEO role in April has been to expand the company’s work into additional programs. He added that, “there [is] a real possibility that by 2030, Mythic could have three or four approved therapies.”

The ADC latest: Pfizer and Genmab’s Tivdak received full FDA approval in April after winning accelerated approval in 2021 for certain recurrent or metastatic cervical cancer.Similarly, AbbVie’s Elahere received full FDA approval in March to treat certain ovarian, fallopian tube and primary peritoneal cancers after its accelerated approval in November 2022.

In addition, AstraZeneca, which has six ADCs in the clinic and more in preclinical development, just announced plans to build a $1.5 billion ADC manufacturing facility in Singapore, marking a huge investment into the complex, multi-part manufacturing process. AZ said the facility will be the company’s first end-to-end production site that fully incorporates all the steps at a commercial scale, and will be operational by 2029.