Like many pharmas these days, AstraZeneca has seen generic competition cut away sales revenue for some of its older flagship medications — and in the respiratory space, where the U.K. company is a world leader, that means a new generation of treatments needs to shine through.

Cue the pharma giant's newest FDA approved medication, Airsupra — a rescue albuterol-corticosteroid inhaler for adult patients suffering an asthma attack that also doubles as a treatment for the underlying cause of inflammation in the airways. The company teamed up with fellow London pharma Avillion in 2018 to develop the treatment.

With AstraZeneca's former respiratory mainstays like Pulmicort facing direct competition, and Symbicort in legal disputes over generic entry, a new first-in-class treatment could help the company keep its footprint in that space. Pulmicort sales fell 31% in the first three months of 2022, while Symbicort has only shown minor signs of weakened revenue for now.

Pulmicort is the brand name for budesonide, a steroid that makes up one of the two parts of Airsupra. Adding albuterol — which has been generic for many years — is an update that gives patients the one-two punch from Airsupra.

And as the company's respiratory and inflammation sector represents about 13% of its overall revenue, these newer products — which include already-launched Fasenra and Bevespi — will be an important crutch moving forward. Airsupra is reportedly forecast to bring in $500 million in peak sales. Now, AstraZeneca is focused on making sure the Airsupra launch goes smoothly, said Dr. Frank Trudo, vice president of U.S. medical affairs in respiratory and immunology.

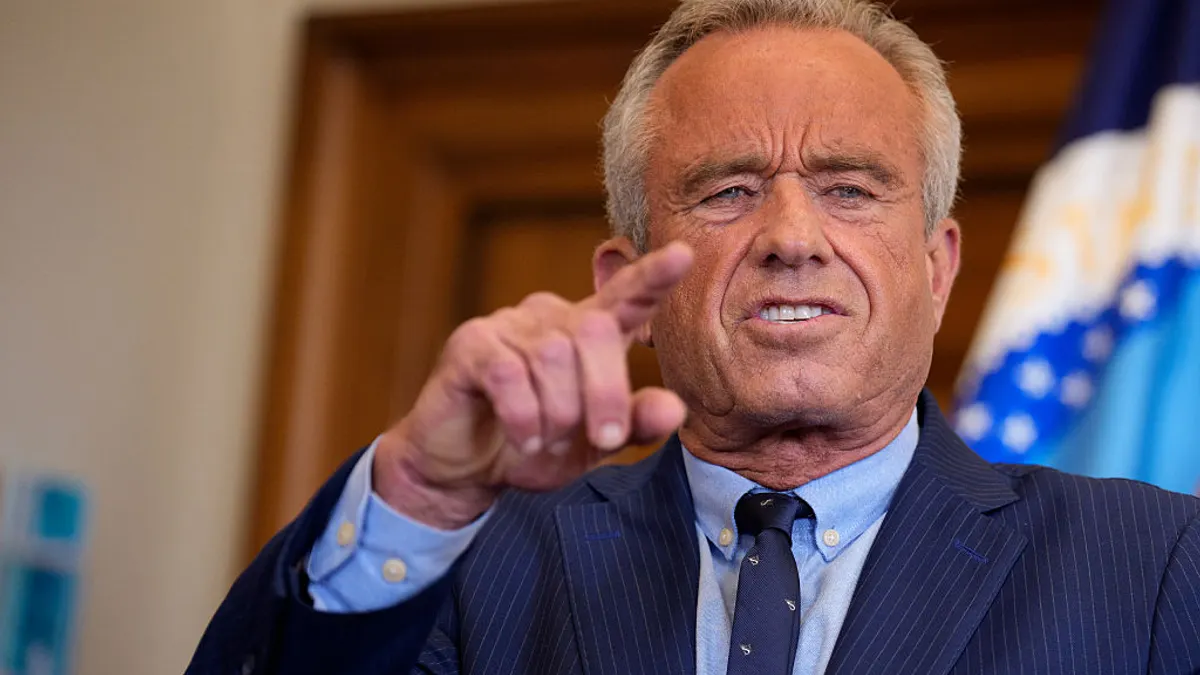

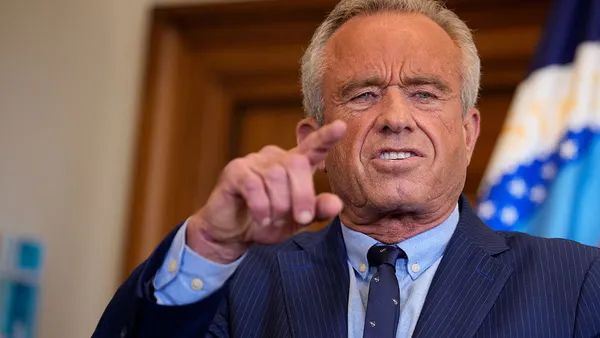

"The current rescue approach only addresses the airway narrowing that happens with asthma but it doesn't address the inflammation," Trudo said. "So there's a window of opportunity when you're using a rescue medication to also introduce an inhaled steroid or an anti-inflammatory to address that inflammation — and that's an important paradigm shift."

An evolving launch strategy

There's one small catch to Airsupra's approval, however: Although AstraZeneca studied the treatment in patients as young as 4 years old, the FDA only gave the go-ahead for adult patients. Only 183 of more than 3,000 patients in the late-stage study were between the ages of 4 and 18, resulting in a design that wasn't optimized for statistical significance in children and adolescents. But the company is aiming to include that important asthma cohort in updated labels down the road.

"We did study patients, younger than 18 in our clinical studies, and we look forward to working with the regulatory authorities to get additional information to address that population as well," Trudo said. "We're still assessing that future development in line with regulatory bodies in accordance with their recommendations."

The launch will require a campaign to ensure that patients and their physicians are aware that a new double-action inhaler is available, Trudo said.

"There is an educational need to make sure that all providers who take care of asthma patients understand that there's an approved approach for adult patients in the U.S. to not only alleviate symptoms from airway narrowing, but also reduce the inflammation that potentially reduces the risk of having a more severe exacerbation," said Trudo, a pulmonologist by training.

Of course, AstraZeneca will also need to convince patients that Airsupra's two-in-one approach is more convenient than taking the two drugs separately. That's where generic competition could still play a role, which brings pricing into the conversation.

"Undoubtedly, the cost of Airsupra will be significantly more than just albuterol alone, which has been generic for many years," wrote allergist and asthma physician Dr. Alan Khadavi in a blog post following the approval. Still, he pointed to the importance of an emergency inhaler regardless of the severity of a patient's asthma. And in an emergency, a single device delivering both remedies can be better than two.

A continued focus on respiratory

AstraZeneca has kept on track in the respiratory space as other companies have peeled off into other avenues. For instance one of the biggest players, GSK, began cutting back in the space in 2020, despite the blockbuster success of its asthma treatment Advair. While it did not abandon respiratory meds altogether, the company cut some early-stage assets that year.

"There's a window of opportunity when you're using a rescue medication to also introduce an inhaled steroid or an anti-inflammatory to address that inflammation — and that's an important paradigm shift."

Frank Trudo

Vice president, medical affairs, respiratory and immunology

AstraZeneca's newest treatments in the respiratory arena demonstrate that the company is invested in the space and willing to innovate where others saw stunted growth. A spokesperson for the company said that "one of AZ’s ambitions in asthma is to eliminate preventable asthma attacks across all severities and achieve clinical remission."

Partnerships with companies like Avillion have helped fuel that fire in the past, and AstraZeneca has continued to put its money where its mouth is with more licensing deals, including one worth up to about $400 million with chronic obstructive pulmonary disorder specialist C4XD in November 2022.

Trudo said that AstraZeneca's many decades with respiratory drugs bring unequaled commitment where there is an unmet medical need.

"As a pulmonologist, I'm very proud to be part of an organization that has committed its resources to advance respiratory care, and Airsupra is a great example of that, where we're trying to cause a paradigm shift in rescue care," Trudo said.