Welcome to today’s Biotech Spotlight, a series featuring companies creating breakthrough technologies and products. Today, we’re looking at Cerevance, a UK-based biotech leveraging a large collection of brain samples to develop therapies for CNS diseases.

In focus with: Craig Thompson, CEO, Cerevance

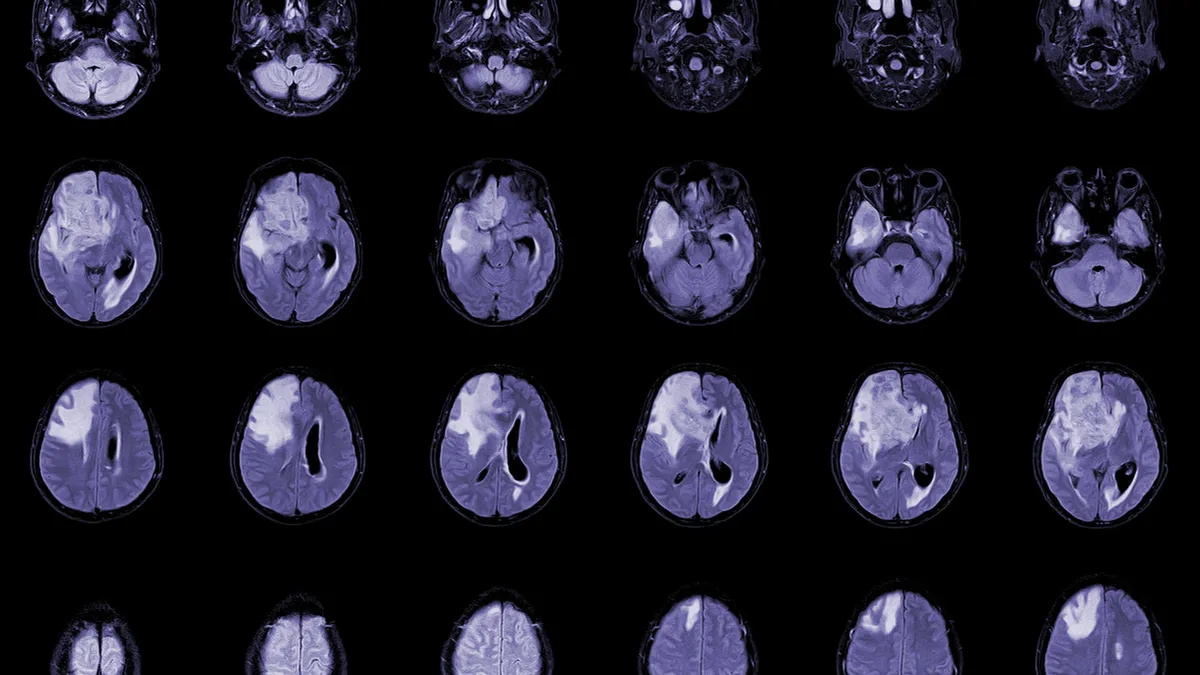

Cerevance’s unique edge: The quest to unlock the secrets of neurodegenerative diseases has long centered around studies of the human brain. U.K.-based Cerevance is leveraging that approach with what CEO Craig Thompson believes could be one of the largest in-house collections of donated brain tissue samples in biotech.

Formed in 2016 with financial backing from Takeda and an in-licensing agreement for its drug discovery platform NETSseq, Cerevance has built a library of 16,000 brain samples from donors aged 8 to 104 at its Cambridge lab. What makes the growing “brain bank” unique, Thompson said, is that it includes samples from those who died from a CNS disorder such as Alzheimer’s alongside donors who died from something else — creating a more contextual picture of how diseases progress.

“We’re seeing insights others don’t see,” Thompson said.

To generate those insights, the company identifies about 12,000 genes per cell type in a tissue sample and has sequenced more than 60 trillion base genetic pairs. Using machine learning and AI tools, Cerevance has stitched together data from “various donors at various stages of the disease,” Thompson said.

Analyzing the gene expression profiles of different cell types and determining which are upregulated or downregulated during these different stages has helped Cerevance zero in on novel therapeutic targets.

Why it matters: While the dopamine pathway has been a mainstay for most drug developers in the Parkinson’s space, Cerevance is taking a different tack with its lead candidate, CVN424. The drug, which is in mid-stage trials as an adjunctive and monotherapy, takes aim at GPR6, a G-protein coupled receptor.

“GPR6 is only expressed in one cell in the striatopallidal pathway … and that’s important because that allows us to push a higher dose [and] we know our effects are going to be limited to that cell type,” Thompson said.

“Our focus is to try and bring precision medicine to neuroscience and look at novel ways to treat patients."

Craig Thompson

CEO, Cerevance

If approved, CVN424’s oral delivery could give it an edge over potential rivals that have to be injected. But the key will be in demonstrating superior efficacy with fewer side effects than other oral drugs, Thompson said.

“What we’re seeing is efficacy close to what’s only achieved with infusion products, but with this drug, the adverse effects are benign,” Thompson said.

Keeping fundraising momentum: Cerevance raised $47 million in fresh funds to fuel clinical work last April through a series B-1 extension round of financing. The cash infusion will help the company advance CVN424 into phase 3 testing as an adjunctive therapy. It’s a space where the drug was shown to be safe and effective at providing symptom relief in a phase 2 study — and where Thompson sees blockbuster potential.

“As an [adjunctive therapy], sales could be in the $1 billion to $3 billion dollar range with modest market penetration,” he said. “If you go above 25% uptake, you’re above that.”

The company’s pipeline also includes an earlier-stage drug aimed at multiple psychiatric conditions, including schizophrenia, as well as a phase 1 Alzheimer’s and ALS candidate targeting a potassium channel called KCNK13.

Despite the “tough” investment market, Thompson said Cerevance has been “good at raising money” in the last few years. Recent successes in the CNS space, such as Eli Lilly’s Alzheimer’s approval for Kisunla this month, have demonstrated the market potential in an area long stymied by clinical setbacks.

“New investors are getting excited by our story,” Thompson said.

With a clinical readout expected this year for CVN424 as a monotherapy in Parkinson’s, Cerevance is weighing a potential IPO. But that decision could come down to market conditions.

“What we don’t want to have happen is [what happens] when other biotechs launch and then later they’re trading at 25% of issuance price,” Thompson said. “We want to see the broader market and where we fit in. But what we hear from bankers is that, given our late-stage portfolio, there’s more of interest to investors.”

In the meantime, Cerevance announced in May that it hit the first milestone in an ongoing research collaboration with Merck & Co. to discover novel targets for Alzheimer’s. Cerevance did not disclose the payout from delivering on the deal or how many targets the collaboration is seeking. But Thompson said the partnership is in line with the broader strategy of leveraging its brain bank and NETSseq platform to uncover new ways of attacking neurodegenerative disease.

“Our focus is to try and bring precision medicine to neuroscience and look at novel ways to treat patients,” he said. “In the end, that’s what we’re all here for — helping patients with these terrible diseases.”