Nine years ago, Lisa Haines got news no one wants to hear. Her doctors said her lung cancer, which chemotherapy had earlier arrested, was growing again.

The Massachusetts resident began planning for family events she thought would be her last, like her son’s wedding and a Thanksgiving trip. Her doctor didn’t give up, however. She recommended Haines try an immunotherapy called Opdivo, one of what was then a new class of drugs that works by enlisting the body’s immune system to fight cancer.

In December 2015, Haines became the first patient at Addison Gilbert Hospital in Gloucester, Mass., to receive Opdivo. The following August, lung inflammation prompted her doctors to stop treatment. But by then, scans showed her disease was stable. Most of what remained was scar tissue. Nearly a decade later, she has no detectable disease.

“I’m alive today because of those drugs,” Haines said. “They’re miraculous when they work.”

Developed by Bristol Myers Squibb, Opdivo was the second so-called PD1 inhibitor to be approved in the U.S. The first, Merck & Co.’s Keytruda, won Food and Drug Administration clearance 10 years ago today.

Keytruda’s initial U.S. approval, which preceded Opdivo’s by a few months, was niche, reserved for people with inoperable melanoma or whose disease had spread and couldn’t be controlled with other medicines. Today, Keytruda is on track to become one of the highest selling pharmaceutical products of all time, supported by approvals for 20 different types of cancer.

In addition to Keytruda and Opdivo, seven other drugs that block the PD1 pathway have reached market. They’ve been used to treat millions of people with cancer.

Along the way, they have reshaped patient and doctor expectations of what cancer treatment can accomplish. In lung cancer like Haines’, the spread of deadly nodules is now most commonly contained with Keytruda-based combinations. In melanoma, metastatic skin lesions are often held in check with Opdivo and another immunotherapy called Yervoy. And facing tumors of the kidney, liver, stomach, breast and lymph system, doctors can choose immunotherapy options instead of older interventions that may be less effective or more toxic.

“I stand at a podium now and talk about curing 50% of patients,” said Hussein Tawbi, an oncologist at MD Anderson Cancer Center who specializes in treating melanoma.

The success of PD1 immunotherapies has also set a high standard for treatment — one that, in the years since, drugmakers and researchers have spent billions of dollars trying unsuccessfully to top. Since the arrival of PD1 drugs, only one new type of these “checkpoint inhibitors” has won approval, defying expectations they’d lead to a new armamentarium of immune-boosting cancer medicines. Now, even Merck is turning more of its research focus to other types of cancer treatment.

“We thought we had enough scientific understanding to unlock the biology,” said Caroline Loew, formerly Bristol Myers’ R&D strategy and planning chief and now CEO of Mural Oncology. “We didn’t; we weren’t quite there.”

Coley’s toxins

For decades, the main prescription for cancer was chemotherapy, which stops tumor growth by essentially poisoning cells that divide rapidly. But chemo affects healthy cells, too, leading to side effects like hair loss and nerve damage.

A huge step forward came in the 1990s and 2000s, when more precise therapies arrived. Herceptin, an antibody drug, changed the way doctors thought about a protein known as HER2 and its role in breast cancer. Gleevec, a chemical medicine, vastly improved the outlook for people with a type of leukemia. While these targeted treatments can be less toxic than chemo, they are usually limited in which cancers they treat.

Immunotherapies work differently. Keytruda, Opdivo and their cousins help circumvent the ways tumor cells evade detection and destruction by the immune system, specifically infection-fighting T cells. Another type of immunotherapy, known as CTLA4 inhibitors, makes T cells work harder to find and eliminate tumor cells.

But the path to understanding the immune system’s role in cancer was long. More than a century ago, scientists were able to guess at a relationship. Most famously, in the 1890s, a surgeon named William Coley noticed how some people with cancer who experienced a bacterial infection unexpectedly had their tumors shrink.

At a time when X-rays were seen as the best way to treat cancer, Coley instead tried injecting bacteria into the tumors of people with cancer. “What he found was that the patient would have an enormous inflammatory response. And then within a couple of days, the tumor would simply melt away,” said Robert Schreiber, a pathology and immunology professor at Washington University who has studied how cancer and the immune system interact.

Scientists of Coley’s time didn’t have the means to tease out the immune system’s role. Only over time did they gain the right tools so that, by the 1960s and 1970s, they could try new experiments with immunocompromised mice.

Unfortunately, the experiments, which involved injecting carcinogens into these mice and into others with healthy immune systems, failed to show any meaningful result. The setback slowed the field’s development for decades.

Schreiber was one of the scientists who began building the foundations that would later enable immunotherapy’s breakout. His experiments, an offshoot of studies into an immune-signaling chemical called gamma interferon, involved mice bred without a certain gene that’s expressed on T cells.

His research found the specially bred mice developed more cancers and did so more rapidly. “We didn't believe it,” Schreiber said. “So we did it over and over and over again, and got the same answer.”

In essence, he was able to show what previous experiments couldn’t: Mice with weakened immune systems weren’t able to fight cancer as well. His lab’s discoveries led to the theory of cancer “immunoediting,” which proposed that, although the immune system could destroy tumor cells, in some cases the response is only powerful enough to keep cancer in check for a short time. During that time, variations can develop that help tumors “escape” immune attack.

‘No tumors anywhere’

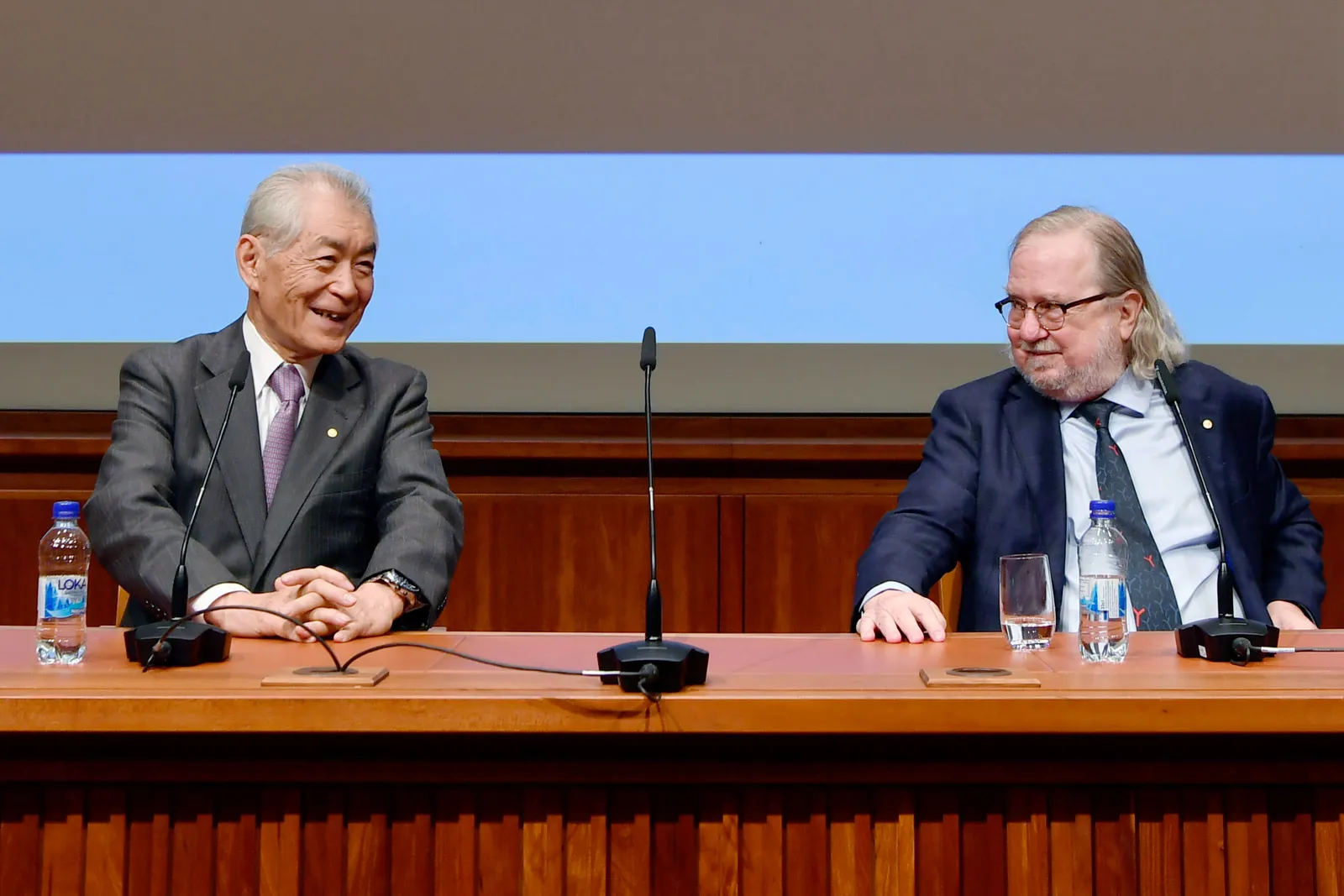

Schreiber’s work helped inform researchers elsewhere. Among them was James Allison, who, with Japanese researcher Tasuku Honjo, eventually won a Nobel Prize for discovering how cancer cells shield themselves from the immune system.

Allison, at MD Anderson, along with researchers at the University of Chicago, found the CTLA4 molecule regulates T cells’ response to tumors. Certain proteins expressed on cancer cells use CTLA4 to essentially tell those T cells to stand down, leading to tumor escape.

This and other molecules became known as immune “checkpoints,” which check, or brake, the body’s immune response. Japanese researchers led by Honjo separately discovered another checkpoint, called PD1, that eventually became the target of Keytruda and Opdivo.

Allison first presented data on CTLA4 in 1995, but found almost no one willing to help him translate his work into drugs that could be tested in humans. One big obstacle was that, at the time, many of the world’s most powerful drug companies considered cancer immunotherapy a dead end. Prior attempts to create a therapeutic cancer “vaccine” had flamed out.

“A lot of the companies I approached said, ‘Immunotherapy has never worked. It's never going to work,’” Allison said.

Complicating matters further, Bristol Myers held intellectual property rights to a drug that targeted CTLA4, making companies wary of licensing Allison’s science.

Eventually, through some of his academic connections, Allison was able to forge a deal with a company called Medarex, which took his findings forward into clinical research.

Medarex was in a hurry. After using Allison’s science to design an antibody that blocked CTLA4, the company took just 466 days to move from a key first step in the laboratory to testing it in humans. That speed has only recently been beaten by Regeneron Pharmaceuticals in its development of a COVID antibody, according to Nils Lonberg, who helped shepherd immunotherapy research while at Medarex and later Bristol Myers.

“We didn’t know if the project was going to work or not,” Lonberg said. “If it didn’t work out, we didn’t want to spend any time or money on this.”

But it worked. The second patient tested with Medarex’s drug was a young woman whose relapsed melanoma got so severe that a metastasized tumor collapsed her lung. She was about to be sent into hospice care. After one treatment with Medarex’s drug, though, her tumor shrank enough doctors could remove it surgically.

Her response was so profound it took her physicians by surprise. At a follow-up imaging scan, Allison recalls the radiologist saying, “There's some mistake here, because there are no tumors anywhere anymore, so it's got to be the wrong patient.”

That patient is still alive in 2024.

In 2004, Bristol Myers partnered with Medarex to work on immunotherapy research that years later would lead to Yervoy and Opdivo. The pharma company followed up five years later by buying its partner for $2.4 billion.

As Bristol Myers moved deeper into testing, results began exciting melanoma specialists who were used to new drug treatments disappointing. Tawbi remembers how, for many doctors then, the first step they would recommend for metastatic melanoma was a clinical trial. Melanoma was “the place where all good drugs go to die.”

“We could give people chemotherapy. Sometimes — rarely — that helped. But there was almost never a durable response,” said Jedd Wolchok, a Weill Cornell Medicine oncologist who ran some of the first clinical trials of checkpoint inhibitors.

The most important data for Yervoy came in 2010, at a plenary session of the American Society of Clinical Oncology’s annual meeting. They showed the drug helped people with melanoma live longer when compared to an experimental vaccine for the cancer.

“I remember sitting in the audience. We actually gasped,” Tawbi said. “I got back to the clinic and used it as soon as I could.”

The FDA approved Yervoy in 2011. But Yervoy’s substantial side effects on the intestines, liver, kidneys and other organs proved difficult to tolerate. And early on, doctors were reluctant to use the steroids that later proved effective in managing the drug’s toxicity.

With Yervoy’s use constrained by side effects, researchers hunted for another immunotherapy that would be as effective in stopping melanoma, but easier for patients to take.

An acquisition afterthought

In the early 2010s, Merck primarily sold cardiovascular and respiratory disease drugs. The company faced a big patent “cliff,” when top-sellers like its asthma medicine Singulair were set to lose market exclusivity.

Merck was also digesting what was then one of the largest pharma acquisitions, a $41 billion takeout of Schering-Plough in 2009.

Two years earlier, Schering-Plough had purchased a company called Organon BioSciences, the human and animal health division of a Netherlands chemical company. At the time, Schering-Plough was excited about Organon’s products in central nervous system diseases and women’s health. But within its labs Organon had developed a little-noticed PD1-targeting antibody it called lambrolizumab.

By the time Merck absorbed Organon, lambrolizumab wasn’t a high priority and, according to reports, was even marked for sale. Right around then, though, Bristol Myers advanced Yervoy into late-stage studies, catching the attention of Merck’s scientists.

“At the time, the whole immuno-oncology space was in its infancy, other than [Yervoy],” said Roy Baynes, Merck’s former chief medical officer. “What really re-energized Merck to develop this was a growing awareness that PD1 looked as though it was going to be important.”

In response, Merck dusted off lambrolizumab, renamed it pembrolizumab and thrust it into clinical trials. Because of its Medarex buyout, Bristol Myers had its own PD1 blocker in Opdivo, and the two companies became locked in a race to get the drugs into the clinic and approved.

The annual ASCO meeting in 2013 provided an early forum for both companies to present initial data from trial volunteers with melanoma. Baynes, who had previously worked with Merck research chief Roger Perlmutter at Amgen, was in attendance.

“Roger sought me out,” Baynes recalled. “He said, ‘What do you think of these data?’ And I said, ‘Well, they look pretty darn good.’ He said, ‘Well, why don't you come and help me develop it?’”

Perlmutter, Baynes and the Merck R&D team were widely viewed by Wall Street as playing catch-up to Bristol Myers. But Merck made up ground with a nimble strategy centered on a large phase 1 trial that transformed from initial dose testing to fuller evaluations of safety and efficacy.

Merck beat Bristol Myers to market with that strategy, gaining an accelerated approval in melanoma for pembrolizumab, or Keytruda, on Sept. 4, 2014, more than three months ahead of Opdivo.

The PD1 drugs offered significant advantages over CTLA4 and Yervoy. Tawbi describes PD1s as “nine times better” than Yervoy — “three times more effective and three times less toxic.” And treatment began changing the lives of patients. “We started being able to sit down with patients and say, ‘You’ve got melanoma, but there’s a 42% chance of a cure,’” he said.

While the two companies worked to shore up those first approvals in melanoma, a second prize awaited in a common form lung cancer.

Once again, Merck got there first, winning U.S. approval a week before Bristol Myers in October 2015 to treat people whose disease worsened following chemotherapy. The approvals came with an important difference, however. To be eligible for Keytruda, people with lung cancer had to test positive for PDL1, the protein to which PD1 receptors bind, while Opdivo’s use wasn’t restricted.

But Bristol Myers’ “all comers” approach eventually led to one of the company’s largest setbacks. In a first-line trial, Merck enrolled people who were positive for PDL1 on at least 50% of their tested tumor cells, while Bristol Myers’ competing trial set the enrollment threshold at 5%. Moreover, Merck designed its trial with more opportunities for Keytruda to succeed, enrolling many more patients and following them for longer.

Merck’s trial succeeded in showing a survival benefit compared to chemotherapy, while Bristol Myers’ failed, an event so momentous Bristol Myers lost billions of dollars in market value.

“It destroyed BMS,” said Lonberg. “We had huge pressure from investors. It radically changed the company. It was just one bad trial design. But there was no clawing our way back.”

As the two companies competed for primacy, they sought to combine their drugs with others to improve on the survival benefit. Merck focused largely on pairing Keytruda with chemotherapy while Bristol Myers tested Opdivo both with Yervoy and with chemotherapy.

More recently, the two companies have focused on earlier-stage disease. Studies have shown immunotherapy can help reduce the size of tumors early so they are small enough to be removed with surgery. The drugs are also now used as follow-up treatment to prevent cancer from returning.

Over the course of the past decade, Merck and Bristol Myers also added approvals in numerous cancer types, including a “tissue agnostic” approval for Keytruda in people with a certain type of genetic mutation. These successes sparked a gold rush among other large pharma companies; First there was Roche with Tecentriq, and then followed drugs developed by Merck KGaA, AstraZeneca, Regeneron, GSK and others.

Merck and Bristol Myers also became the partner of choice for companies seeking to develop new cancer drugs, with hundreds of combination trials launched over the past 10 years.

Doctors have now used Keytruda to treat 2.5 million people, and the drug is currently in 1,600 studies, according to Merck’s own tally. During this year’s ASCO meeting, Merck CEO Robert Davis said the company has spent $46 billion developing Keytruda and expects to invest another $20 billion by 2030.

By comparison, Opdivo has been used to treat 1.8 million people and tested in 500 clinical trials, according to Bristol Myers.

‘I hope to get a postcard from you’

For patients, it’s hard to understate the impact of immunotherapy. Haines, the lung cancer survivor, has been disease-free since ending Opdivo treatment in 2016. “They won’t say if it’s curative for some people but it’s pretty darn close,” she said. “I still get nervous whenever I get a scan. My oncologist says, ‘You’re good.’”

Heidi Nafman-Onda learned she had Stage 3A lung cancer from a scan following treatment for an ovarian cyst. At an initial consultation with a pulmonologist, she was told her tumor was inoperable. They said, “your prognosis is poor, you have four to six months left and you should get your affairs in order,” Onda recalled.

However, she was surprised by an oncologist in a follow-up visit. “He walked into the office all chipper and smiling. I wondered what he was smiling about,” Onda said. He told her an AstraZeneca immunotherapy called Imfinzi had been approved and that it could cure many patients with her diagnosis. “He said, ‘I hope to get a postcard from you in 10 years from some exotic vacation you’ve been on.’”

When she was about to begin treatment, her care team gave her extensive information about side effects. “I said, ‘I don’t want to look at it.’ This was my only option. It was either that or die soon.”

Her one year of Imfinzi treatment ended January 2020. “To this day I have no evidence of disease. They can’t see any trace,” said Onda, who co-founded the White Ribbon Project to raise awareness of lung cancer.

Pamela Berryhill, who had difficult with the side effects of Imfinzi and other drugs prescribed to treat her lung cancer, has found a tolerable regimen in Keytruda and the chemotherapy Alimta.

“They are telling me that this will be my lifetime treatment,” said Berryhill. “I can see myself being on this happily for the rest of my life because the side effects that I get are minimal and bearable — just giving myself a little bit of grace after the treatment to deal with the fatigue and fuzzy head feeling.”

For doctors who’ve been treating lung cancer for years, this is a remarkable turn of events. “I was in medical school in the ‘90s and medical oncology residency in the early 2000s. We had old platinum-based chemotherapy, and really not much more,” said Tina Cascone, a thoracic, head and neck cancer specialist at MD Anderson.

Now, there are a “plethora” of agents to use to improve survival. “We are able to tell our patients more and more there is no evidence of disease, that they’re cancer free, and they can go on with their life,” she said.

Still, PD1 drugs are not panaceas. While in many cancers they work better than alternative treatments, the majority, or even sometimes most, of treated patients don’t respond fully. Testing for certain biomarkers can help identify patients most likely to respond to treatment, but isn’t a guarantee. So far, too, deadly cancers of the brain, ovaries, prostate and blood have proven harder to treat with immunotherapy, for reasons that drugmakers are still sorting out.

“Not all patients benefit from these treatments,” Cascone said. “Some patients still will experience severe side effects [that] impact the quality of life.” She said more research needs to be done to identify which patients will benefit and how immunotherapy can be better tailored.

Drugs approved by the FDA that target the PD1 pathway

The me-too trap

PD1 drugs have undoubtedly improved cancer treatment. Yet, despite much trying in the decade since they’ve launched, pharma companies haven’t been able to replicate their success.

New targeted treatments such as Tagrisso and Ibrance have helped people with certain solid tumors, while, in the field of immunotherapy, engineered cell therapies like Kymriah can produce durable survival benefits for people with blood cancers. But their reach is more limited than Keytruda’s or Opdivo’s. And while Bristol Myers has had success exploring a new immune checkpoint called LAG3, others’ attempts to rewire the immune system against cancer have mostly met with failure.

For its part, Merck doesn’t see its future in new cancer immunotherapies. Instead it’s leaning into targeted treatments. “We're not out there saying, ‘Let's find the next Keytruda.’ That was lightning in a bottle,” Davis said at the ASCO 2024 press conference. “Most of what we're looking at are therapies that are very specific.”

According to Weill Cornell’s Wolchok, one reason for the slow progress is that pharma companies and academics spent too much time and money trying to develop new PD1s or to combine new agents with PD1s in hopes of finding an additive benefit.

“There's no reason why we need the number of PD1-blocking drugs that we have,” he said. “What if we [had] tried to uncover another foundational checkpoint rather than making additional copies of similar drugs?”

The checkpoint inhibitors tested after PD1 weren’t particularly effective on their own. Nonetheless companies pushed them into expensive combination trials, lured by the financial promise of finding the next immunotherapy.

“What we've learned is single agent activity is really important,” he said. “What we call IO-IO combinations, that is two checkpoints put together, have been really underwhelming.”

However, Allison argues, other checkpoint inhibitors haven't been evaluated correctly yet. “We’ve got to change the way we think about testing,” he added. His laboratory is currently working on iterative small trials that can help tease out the benefit of targeting other checkpoints. And he notes how some immune checkpoints don’t seem to emerge until tumor cells are first exposed to PD1- or CTLA4-blocking drugs

Bristol Myers still sees its immunotherapies as backbone treatments, but is extending the combination to emerging drug classes like precisely targeted radiotherapies and chemotherapies. “It really does start with harnessing your own immune system to fight cancer and that gives us the ability to have that durable, long-term survival impact,” said Adam Lenkowsky, Bristol Myers’ chief commercial officer.

Even so, disappointment has been felt throughout the field.

“Combination development naturally becomes very complicated,” said Loew, of Mural Oncology. “All of that work, in the end, didn't result in anything except with LAG3.”

Loew claims cancer immunotherapy research is following a fairly typical pattern, though. Generally, drug development occurs in 10-year cycles, she said, and in immunotherapy, “we’re about to see another evolution, another step change.”

Lonberg, who’s now an executive-in-residence at the venture capital firm Canaan Partners, is also optimistic. Still, he concedes investment may flow away from some biotechnology companies as the field evolves.

“The more sophisticated players are going to survive and thrive,” he said, “and there will be renewed interest in immunotherapy because of that.”