In the Alzheimer’s treatment market, a win can become a loss very quickly, and a loss can become a win. Even the experts have lessons to learn. For Cognition Therapeutics, getting this balance right has been complicated.

In a mid-stage study called Shine, the company’s sigma-2 agonist Alzheimer’s therapy didn’t match investors’ expectations. The stock fell 43% when Cognition released results, usually an indication of a failure.

But Cognition leaders thought the study was a success. What happened?

Smaller companies have a harder time proving their science, said Cognition CEO Lisa Ricciardi, and the bigger ones are more likely to give their data a better shine to whet investors’ appetites.

“The trials stand up,” Ricciardi said. “Other companies might have picked and selected [data] … and people don’t have these concerns when Eisai or Biogen or Lilly is standing on a dais revealing their data.”

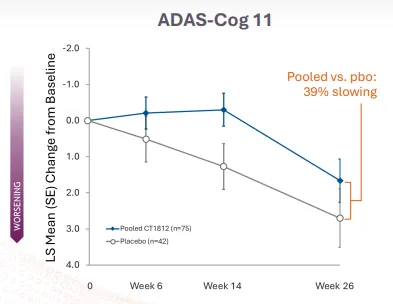

Among 153 adults with mild to moderate Alzheimer’s disease in the study, patients were measured over 182 days according to a scale that determines cognitive decline, known as ADAS-Cog 11. Patients who received the drug, called CT1812, showed 39% less decline than those receiving a placebo.While that’s how Cognition leadership saw the results, investors took note of a different story.

From their perspective, the decline in the placebo arm was about 2.7 points on the scale compared to 1.66 for patients who took CT1812, marking just over a 1-point difference in cognition between placebo and drug, a statistically insignificant change. And the company was a victim of its earlier success — a November 2023 interim readout showed a difference of three points in the first 24 patients, so the full results didn’t hit that same high.

But Cognition chief medical officer and head of R&D Dr. Anthony Caggiano sees the 39% less decline as a major win, even compared to drugs like Eisai and Biogen’s Leqembi or Eli Lilly’s Kisunla, known formerly as lecanemab and donanemab, respectively.

“I think the magnitude here is good — if you look at lecanemab and donanemab over 18 months, they showed a 25% and 30% slowing,” Caggiano said.

The difference that made the study look less successful was how well patients improved in the placebo arm later in the study after the interim results were revealed, Ricciardi said. Looking at a chart that shows the study’s progress over time, she feels the results were misconstrued.

‘People listen short’

Part of the problem is the rift between what is happening in the study and what people want to hear, Ricciardi said.

“People listen short, and this takes explanation,” Ricciardi said. “But the headlines will be read on a press release before the data comes out, and that will trigger a certain level of activity in the market, and then you have a self-fulfilling prophecy.”

Cognition isn’t the only company with confusion surrounding a recent study. A high-profile schizophrenia treatment from Neurocrine was touted as a success, but competitive forces prompted an investor selloff. It goes to show, results are about more than just the main figures in a study.

And again, being a smaller company, there’s more scrutiny on smaller studies, Caggiano said.

“We’re in a unique position of having these small proof-of-concept studies highlighted for the whole world,” Caggiano said. “You know, Pfizer, Lilly, Merck — they’re not telling anybody about these studies. We don’t have 1,200 molecules in development. We have one.”

And the rate at which the Alzheimer’s market is changing adds another level of volatility, Ricciardi said.

“Everybody wants a piece of a good market that’s growing,” she said. “Everyone says, wow, I hope you have these drugs when I need them — nobody feels immune to it and that’s a part of why they’re interested in the development of these programs.”

Cognition has CT1812 in other phase 2 studies for dementia with Lewy bodies, early Alzheimer’s and macular degeneration, so the drug’s story doesn’t end here, and the company isn’t letting the mixed reaction to the Shine study halt progress.