Imagine a game of “telephone,” in which a whispered phrase shifts as it works through a crowd.

Now, imagine that each person in the game is financially incentivized along the line to drastically change the phrase for their own benefit. That’s what drug pricing currently looks like, said Wayne Winegarden, director of the Pacific Research Institute’s Center for Medical Economics and Innovation — through a lack of transparency in the system, prices can become unpredictable and grow out of control.

Would full transparency from drugmakers, insurers, pharmacy benefit managers and hospitals make that system fairer and less likely to result in higher-than-expected costs? The answer is also complicated, Winegarden said.

“The problem is that there are so many different prices, and everyone’s negotiating different prices, and it undermines the whole purpose of pricing, which is to convey information about scarcity and value,” Winegarden said. “When you don’t have a mechanism to accurately incorporate that information in a price, your market is going to malfunction — and that’s what’s going on in healthcare.”

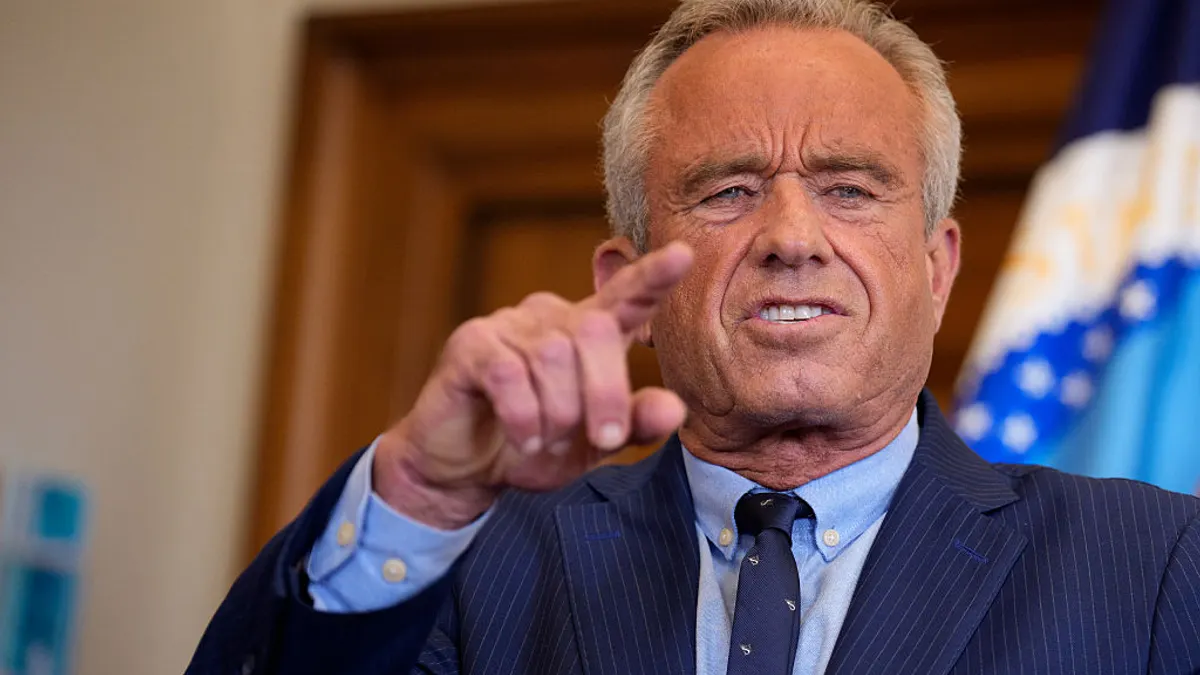

The issue of transparency is a major pillar of the Trump administration’s strategy to lower healthcare prices. The president last month signed an executive order calling on federal agencies like the Departments of the Treasury, Labor and Health and Human Services to “rapidly implement and enforce the Trump healthcare price transparency regulations, which were slow walked by the prior administration,” according to a White House fact sheet.

While the executive order is short on details, it signals an effort to enforce actions from the first Trump administration mandating public pricing disclosures from hospitals and insurers.

Because of those previous policies, some pricing became less obfuscated in the process, but many pharmacies largely reported average sales price, which can be a misleading figure, said Chris O’Dell, senior vice president of market solutions at Turquoise Health, a platform that consolidates pricing information for employers and other healthcare consumers.

“In the simplest terms, for a patient, what that means is that today you can see all the prices in healthcare, whether that’s a drug administered by a doctor or if you’re picking up a prescription from a pharmacy,” O’Dell said, noting that while the average sales price requirements are still in place, they haven’t had the teeth necessary for full transparency. “What this executive order is saying is that we're going to enforce that pharmacy requirement.”

The complexity of the industry’s labyrinthine pricing structure will make complete transparency difficult to achieve, experts agree, but drugmakers in particular should celebrate a move toward better visibility, O’Dell said.

“The opaque system that we've gotten to is that the drug value chain is driven more by the rebate and discount you get than by the actual price of the drug,” O’Dell said. “Manufacturers should love price transparency, and for the most part they do.”

Changing care landscape

Amid the pricing transparency push, the drug landscape has shifted to more effective and specialized treatments like biologics and cell and gene therapies that come with a different financial calculus, Winegarden said.

“Drugs are changing dramatically,” Winegarden said. “With something like gene therapies, which offers a whole new set of opportunities, there’s also a whole new issue in terms of costs.”

But for patients and doctors, as well as insurers and employers choosing benefits, decision-making requires trustworthy information.

“The people who should be making the decisions are patients and doctors, but they really have no idea what those prices are or what they mean,” Winegarden said. “Markets need to settle on an equilibrium price that is both transparent and meaningful.”

Beyond an executive order, lawmakers have the chance to change how pharmacy benefit managers make pricing decisions public, Winegarden said. But although reform has bipartisan support, it has faltered in Congress.

“We all agree [PBM reform] should be done, but, you know, in this type of environment, it's hard to get some of these necessary reforms on the table,” Winegarden said. “We really don't have time for the silliness on The Hill — there are serious issues that need to be addressed, and we really need to get to the business of legislating.”

“The opaque system that we've gotten to is that the drug value chain is driven more by the rebate and discount you get than by the actual price of the drug. Manufacturers should love price transparency, and for the most part they do.”

Chris O’Dell

Senior vice president, market solutions, Turquoise Health

Short of further laws and regulations, some market solutions have emerged, like Turquoise’s pricing transparency platform, and a similar app from a company called Peek, that aggregates and consolidates drug pricing for patients and their employers.

“Historically, employers use the PBM and don't get involved with the manufacturer,” said Michael Navin, Peek’s CEO and founder. “We're trying to create that connectivity so there can be direct pricing, direct relationships.”

Navin has seen firsthand the kinds of hoops drugmakers jump through to hit the right price point, which is sometimes changed drastically by rebates and other fees.

“We were helping out a brand launch last year, and the CEO wanted to make $200 on this drug — so the price was $970, and that shouldn't happen,” Navin said. “The current state has led to so many pricing games, and so many pricing hurdles and strategies that it's gotten far afield.”

Drugmakers like UCB, which recently released a transparency and pricing report, support reform for PBMs as a means to better control what people pay for their drugs. Another battle pharmas are fighting is alleged hospital manipulation of the 340B program that requires manufacturers to sell drugs at a discounted rate to low-income hospitals and has become a haven for some of these pricing games, said Winegarden.

“You get into these industry pissing matches, and whether you win or not, nobody comes out smelling good,” Winegarden said.

Reversing the spiral

While platforms like Turquoise or Peek offer some transparency to drug pricing, the effort also needs to be untethered from the spiral that leads to more pieces of the pie being chipped away, Navin said.

“I started working on the payer side of pharma in 1999, and I saw all sorts of iterations happening, but the PBMs were fairly easy to deal with,” Navin said, pointing to more straightforward formularies and smaller rebates. “Now the rebates are 70%, 80%, 90%, and they won’t even look at drugs that are under $1,000 because they can’t make any money — and the manufacturer refuses to up their price to meet the demand of the PBM because they want to give a fair price to the patient, so there’s this dichotomy that leads to higher costs, limited access or both.”

The ultimate goal for platforms like Peek, Navin said, is to work directly with manufacturers and other sellers. For example, Peek works with Cost Plus Drugs, the startup launched by billionaire entrepreneur Mark Cuban, as one of its providers. Cost Plus Drugs then partners with “pass-through” PBMs, which passes all rebates, fees and discounts on to the plan sponsor.

“If you look at the 26 pass-through PBMs Cost Plus is partnered with, they make money from the services they provide and are very transparent in how they do so,” Cuban wrote to PharmaVoice in an email. “PBMs that offer these services are very valuable. They are the link between the pharmacy, manufacturers and sponsor — most importantly they are completely transparent on all business points.”

Most of all, while attempts at reform are not aimed at curbing profits for actual services provided, the goal is to consolidate that information so they’re available to the public in a way that isn’t overly complicated and opaque.

“Pricing gets very opaque because it means the more discounts and rebates you give, the more hungry everyone becomes who gets a piece of those,” O’Dell said. “And the opaque system that we've gotten to is that the drug value chain is driven more by the rebate and discount you get than by the actual price of the drug.”