Welcome to Biotech Spotlight, a series featuring companies with breakthrough technologies and strategies. Today, we’re looking at Everest Medicines, a late-stage clinical company, which is banking on partnerships and organic R&D to meet the unmet demands of the world’s second-largest pharmaceutical market.

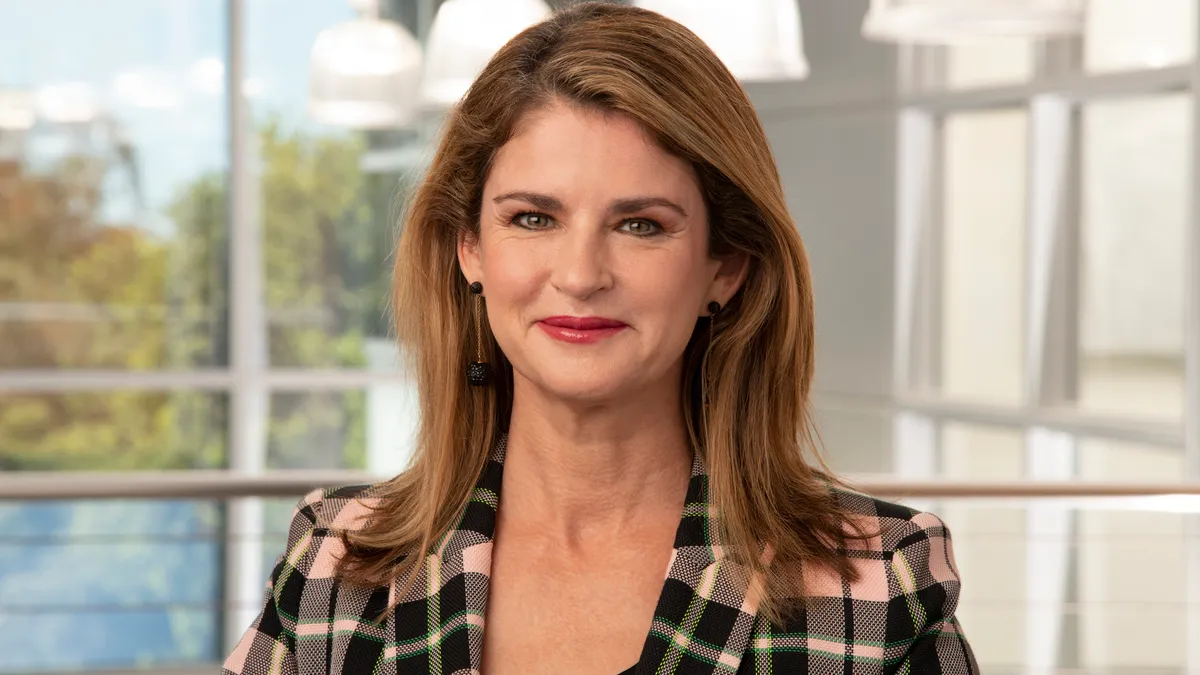

In focus with: Dr. Kerry Blanchard, CEO

Everest Medicines’ vision: With 11 ongoing clinical trials, eight of which are in late stages, Everest Medicines aims to be a top-three integrated biopharma company in the Asia Pacific region by 2030. The company is engaged in more than a dozen strategic partnerships to bring a portfolio of first-in-class or best-in-class product candidates focused on three therapeutic areas — oncology/immunology, cardio-renal disease and infectious disease — through development and to market. The company also has an internal discovery platform that it expects will yield candidates in 2023.

Why it matters: China is the world’s second-largest pharmaceutical market with the “largest number of patients across most therapeutic areas.” In 2019 there were 4.4 million new diagnosed cancer patients compared with 1.8 million in the U.S. And the disease incidence is expected to increase to 5.7 million by 2030 compared with 2.2 million in the U.S. According to a January 2020 Frost & Sullivan report, China’s pharma sector had a pipeline of more than 700 molecules and is focusing on transitioning from an “imitator to innovator, by propelling its biologics pipeline.”

The company’s strategy: Everest’s approach is multi-pronged: key partnerships to bring breakthrough medicines through development and to market; the discovery, development and commercialization of mRNA vaccines; an organic discovery engine focused on broadening the applications of mRNA technology; and an in-house GMP/GSP manufacturing facility for mRNA COVID-19 vaccines and other molecule production.

At a glance: In each area of its therapeutic focus, the company has an asset to generate near-term revenue: In oncology it’s Trodelvy through a partnership with Gilead; in cardio-renal it’s Nefecon through a partnership with Calliditas Therapeutics; and in infectious disease it’s an mRNA vaccine candidate called PTX-COVID-19-B, co-developed with Providence Therapeutics.

Meanwhile, Everest also has an internal discovery platform with three programs in oncology, one in renal, and several projects in the mRNA space. According to the company, the platform is expected to deliver its first preclinical candidate by early 2023.

Over the next three to five years, Everest expects to launch etrasimod for ulcerative colitis, ralinepag for pulmonary hypertension — both in development with Arena Pharmaceuticals — and taniborbactam for cUTI, which Everest is developing with Venatorx Pharmaceuticals.

Here, Blanchard talks about the rise of the Chinese pharmaceutical market, the company’s strategic and development plans, priorities for the coming year and more.

PharmaVoice: Partnerships are key to your business plan, how do you decide on the alliances to pursue?

Dr. Kerry Blanchard: When selecting business development projects, we focus on drug candidates that will address critical unmet medical needs in Asia. Everest’s growth strategy has shifted from licensing late-stage assets with regional rights to licensing early-stage assets and securing global rights, allowing us to demonstrate our discovery efforts and offer potential out-licensing opportunities, further establishing Everest as a rising force in Asia biotech.

What are your strategic objectives for 2022?

In 2022, we will endeavor to work with our partner Gilead on the expansion of new indications for Trodelvy — sacituzumab govitecan — in metastatic urothelial cancer, HR+/HER2- metastatic breast cancer, non-small cell lung cancer and other high TROP-2 expression cancers.

For our cardio-renal drug candidate Nefecon, we anticipate topline results from the phase 3 NefIgArd trial in Chinese IgAN patients and the subsequent NDA filing in China in 2022.

Our mRNA COVID-19 vaccine, PTX-COVID19-B, is currently being evaluated in a head-to-head phase 2 study against the Comirnaty vaccine sponsored by our partner, Providence Therapeutics. The data readout is expected in the first half of 2022 and Providence anticipates filing for an EUA in one major market with the phase 2 study data. Subsequently, we will attempt filing for an EUA in Southeast Asia if the EUA is granted to Providence. Meanwhile, PTX-COVID19-B has been included in the WHO Solidarity Trial Vaccines Program, which may expedite EUA approval in Southeast regions as early as the year-end of 2022.

In addition, we are initiating a phase 3 trial of eravacycline for the treatment of community-acquired bacterial pneumonia in the second half of 2022.

We will continue to expand our innovative drug portfolio in areas of high unmet medical needs through in-licensing and building our organic discovery capabilities. We are actively growing our discovery team by recruiting experienced talent in drug discovery and translational medicines. We are also exploring new modalities and technology platforms, including leveraging AI in the selection of candidates to speed up drug discovery, and advance drugs to pre-clinical development. Our new research laboratory in Zhangjiang, Shanghai, is expected to be fully operational in the first quarter of 2022. Business development efforts are ongoing as we continue to identify assets and technologies that complement our existing portfolio and offer opportunities for commercial synergy, as well as a potential share of global economics.

We will continue to build our commercial infrastructure with deep expertise in sales, marketing, medical affairs, market access strategies, distribution and key accounts across therapeutic areas to support our upcoming commercial launch of Trodelvy and Xerava.

In addition, we are building our own GMP/Good Supply Practice manufacturing facilities in China for mRNA COVID-19 vaccine production and for other molecules as well. The mRNA manufacturing facilities in Jiashan, China, are expected to be in production in the second half of 2022.

What area of the business has the most potential in terms of investor interest?

Since the founding of the company in July 2017, we have strategically built a portfolio of 10 promising clinical-stage drug candidates across oncology, immunology, cardio-renal disease and infectious disease. We have targeted these therapeutic areas based on the severity of the unmet medical needs, the size of the at-risk patient population and the emergence of innovative products globally. We are currently running 11 trials, of which eight are pivotal trials.