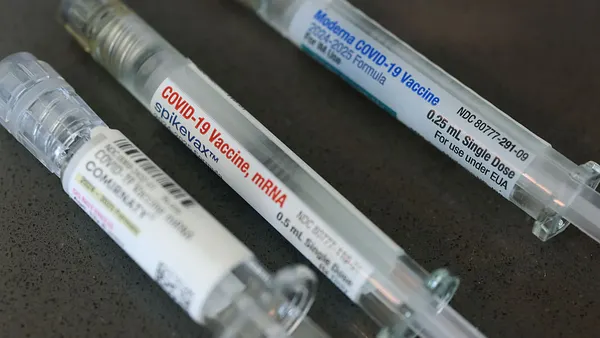

The Trump administration is greasing the wheels of pharma manufacturing in the U.S., most recently with a new program dubbed PreCheck that aims to ease the process of bringing domestic facilities online.

Using a two-phase approach, the program offers drug companies more frequent communication with the agency in early stages and streamlines development through pre-application meetings and early feedback in “the chemistry, manufacturing and controls section of the application,” the FDA said in its announcement.

PreCheck is the latest move from the Trump administration to reduce overseas reliance on drugs, stemming from an executive order in May directing the FDA to reduce regulatory barriers for new facilities. It takes between five and 10 years to build out a new pharma manufacturing facility and receive approval, according to the White House, a timeline President Trump called “unacceptable from a national security standpoint” in his executive order. According to the FDA, PreCheck will “maximize” review times and improve predictability in the process.

The program is yet another lever being pulled by the administration to boost manufacturing stateside. It’s also not the first attempt to speed up review times — the FDA also proposed a voucher program earlier this year to reduce drug review timelines. The agency, which is operating with a reduced workforce, said it will hold a public meeting to discuss the framework of the program and answer stakeholders’ questions Sept. 30.

Here’s how the program fits into the broader push for U.S. manufacturing.

Incoming tariffs

Over the last few weeks, Trump has been steadfast that he will implement tariffs on the pharma industry, recently claiming he will initiate a small tariff before pushing levies up to 180% in 18 months, eventually reaching 250%. The move intends to further incentivize a U.S.-based drug supply.

But even with a reduced timeline to bring new manufacturing facilities online in the U.S., tariffs could still make drugs more expensive. The pharma industry could face up to $19 billion in added costs for a 15% tariff, analysts told Reuters in late July. That’s because the U.S. imports the majority of its drug and active pharmaceutical ingredients from overseas.

On the same day the FDA announced the PreCheck program, the agency’s Center for Drug Evaluation and Research also released a report detailing trends and insights about U.S. drug manufacturers and the U.S. drug supply.

Just 41% of drug manufacturing sites regulated by the FDA are located in the U.S., according to the report. Plus, the number of manufacturing sites rose faster outside the U.S. The amount of U.S. sites increased 7% over the last five years, for example, while sites in China rose 27% and 18% in India.

The pharma industry has opposed levies.

“Tariffs on the biopharmaceutical industry would threaten continued investment and medical progress,” industry group PhRMA said in a statement in May. In addition, the association said, “Imposing tariffs on medicines would be counterproductive to the Administration’s goal of bolstering American industry.”

Trump has yet to release details about the incoming pharma tariffs, and so far the industry has dodged the levies that have already been imposed on other industries.

Manufacturing announcements

As the Trump administration strongarms drugmakers into lowering prices, several Big Pharma players are making moves to ramp up manufacturing in the U.S. to avoid tariffs.

In just the last few weeks, AstraZeneca, Biogen and Thermo Fisher have announced investments for new facilities in North Carolina and Virginia. Meanwhile, Eli Lilly, Johnson & Johnson and Roche are plunking down billions to expand their U.S. manufacturing capabilities.

Earlier this year, Lilly said it would spend an additional $27 billion on new U.S. manufacturing, bringing its total amount to $50 billion over five years. J&J’s total spend is expected to reach $55 billion on U.S. manufacturing over the next four years, while Roche is also investing $50 billion.

With drugmakers setting their sights on quickly ramping up U.S. manufacturing, the PreCheck model could offer a helping hand.