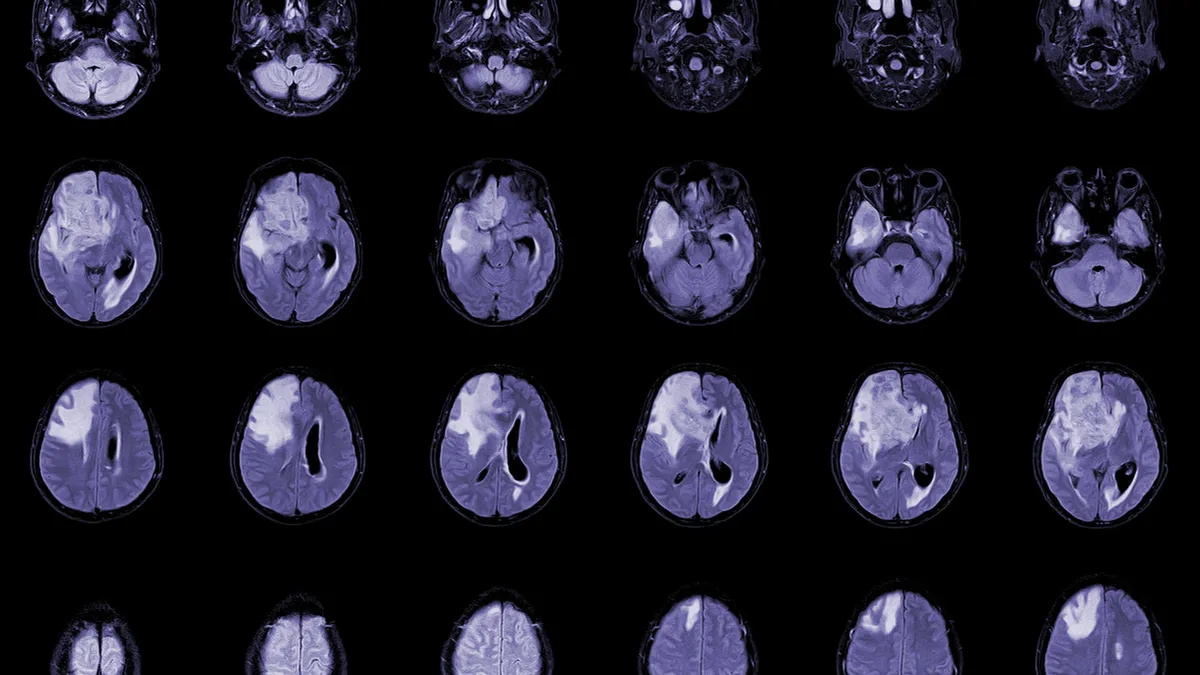

GSK’s blockbuster Shingrix has been shown to be highly effective at preventing shingles and postherpetic neuralgia, a common shingles complication, in healthy older adults. Its effectiveness has legs, too, with immunity sticking around for at least seven years.

But it also has a range of short-term side effects — including large areas of swelling and redness, muscle pain and stomach issues — that sideline 1 in 6 people from their regular activities, according to the CDC.

“It's been associated with these kinds of short duration but severe reactogenic events,” said George Simeon, CEO of the Washington-based, clinical-stage biotech Curevo Vaccine. “There’s a twofold result. Some people are scared of getting the vaccine, and some people who get the first dose don’t get the second … if they have a bad first reaction, they won’t go back for the second.”

Still, Shingrix is the only game in town. Merck & Co.’s Zostavax was discontinued in 2020 because of waning effectiveness over time. Curevo hopes to change that and go head-to-head with GSK’s Shingrix — which notched $4.3 billion sales last year — with a vaccine that’s as effective but has a lower rate of side effects.

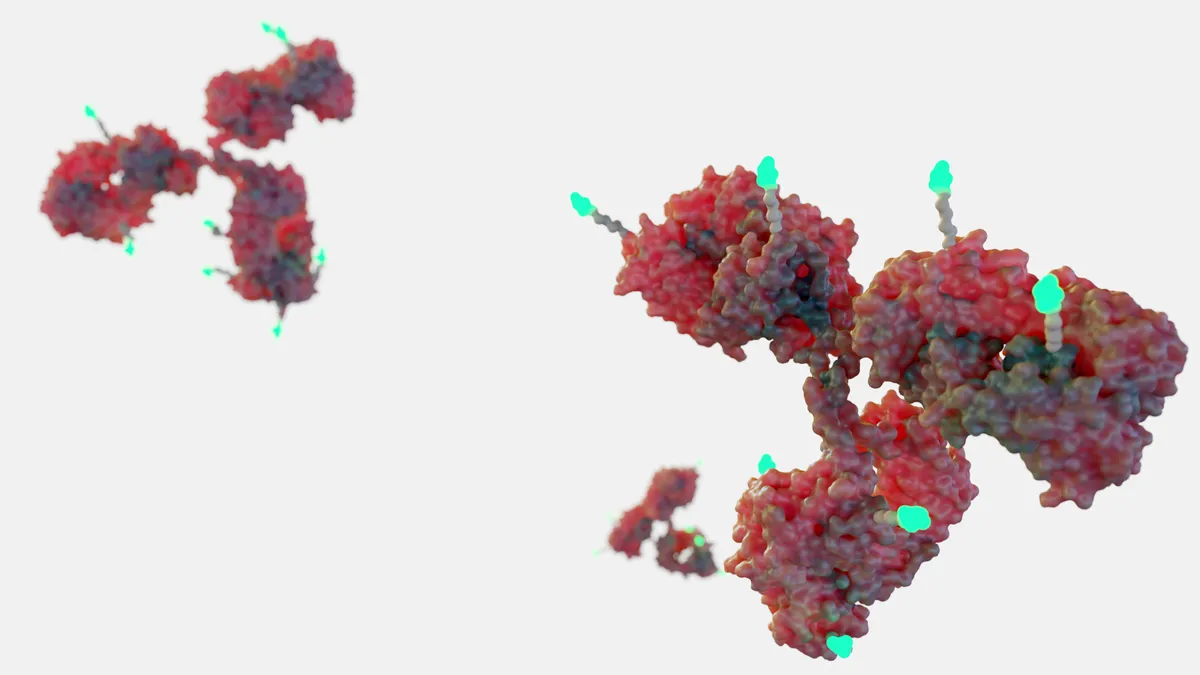

The clinical-stage company is currently developing amezosvatein, a shingles vaccine that a phase 2 trial showed had a 100% vaccine response rate compared to Shingrix’s 97.9%. In addition, fewer patients experienced the kinds of adverse events that interfere with daily activities.

"We are very focused on this one virus. I think it’s a good position to be in now as a company."

George Simeon

CEO, Curevo Vaccine

Like Shingrix, amezosvatein pairs a subunit protein antigen called glycoprotein E with an adjuvant targeting the TLR4 pathway. However, amezosvatein’s adjuvant is synthetic and more targeted, Simeon said.

“The vaccine was very consistently at a good reactogenicity profile across all doses,” Simeon said. “We could get a better immune response without the penalty of these more severe side effects.”

Those positive findings allowed the company to identify a dose to move forward with a phase 3 program, which Simeon said they’re planning to launch by the end of 2024. The company is also trialing a vaccine using the same technology in chickenpox.

Here, Simeon discusses the company’s focused strategy in the vaccine market and how Curevo fits in.

This interview has been edited for brevity and style.

PHARMAVOICE: How is the landscape for shingles vaccines developing in the U.S.?

GEORGE SIMEON: Right now, there's really only one vaccine on the market, and that’s Shingrix. There are a couple of other [mRNA] vaccines in development [from Moderna, and Pfizer and BioNTech].

Every vaccine has to bring something to the table to have a successful market launch. The way we look at the market is that you can’t beat Shingrix in terms of efficacy. And you need to at least meet it or beat it in the durability of the immune response, and so far Shingrix is shown to be durable [for] years. You have to beat it on reactogenicity. And that’s where we're targeting our approach. The mRNA vaccines, at least with COVID and some data as well with flu, have shown some significant reactogenicity. So I question whether they're going to be able to beat Shingrix on reactogenicity. And with COVID, certainly, durability has been an issue. I don’t know if it’s going to be the same with [the] zoster [virus, which causes shingles], but that’s something that they’re going to have to demonstrate.

Can you tell us about the company’s work in chickenpox?

With chickenpox, we’ve engaged in discussions … about the clinical need in children that are immune compromised. Live attenuated virus vaccines still present children, in this case, with a virus, and that virus can cause disease. With children that are immune compromised, they’re susceptible to serious infections of chickenpox. The children we’re talking about are … transplant patients, pediatric oncology [patients] and HIV-positive children.

We've had a number of interactions with clinicians in South Africa and with the regulatory authorities in South Africa, and there’s a need for an effective varicella vaccine that can be administered to this population that’s at the highest risk of having this complication of chickenpox. So we were given authorization to do a trial — a very carefully monitored AIDS de-escalation trial, where we progressively look at the safety and immune responses in children that have this real clinical need.

Will Curevo’s pipeline eventually expand beyond chickenpox and shingles?

No. We are very focused on this one virus. I think it's a good position to be in now as a company. But I also think it's a wise business decision. It’s incredibly difficult to be an expert even with just one virus, and I don't want to distract myself and the company in other markets that are equally as complex. We're finding that just developing the depth of scientific knowledge and clinical expertise, regulatory expertise in this one area is all consuming.

It’s my view that we should be the undisputed knowledge and science experts in this one area in order to serve the global market. It allows us to be very good at something that contributes to all of humanity in one area.

How does that affect your financial strategy and how investors are approaching the company?

In 2019, and even into 2020, it took a very special investor to invest in a very focused company. I went to dozens of meetings, and the only question was: What's your platform? Being focused, we didn’t get into COVID, we didn’t get into a whole number of areas that were outside of our core competence, and we're one of the few vaccine companies moving into phase 3. After this two-year trough in financing and funding and IPOs, this strategy has validated itself with investors. Every investor that I meet is excited about having a focused company. Out of the 35 to 40 investor meetings I’ve had, I think only one has asked me, ‘What are your plans beyond the varicella-zoster virus?’ So the focus and the drive to get one thing to market — a safe, effective vaccine — in the minimum amount of time possible, as efficiently as possible, resonates very well in today's investment climate, which is picking up. They like the story.