Executives at Johnson & Johnson are certainly aware of the tough economic environment — inflation, geopolitical affairs and pricing pressure are formidable foes. But leaders at the largest pharma company in the world are also not giving up on their goal to reach $60 billion in drug sales by 2025.

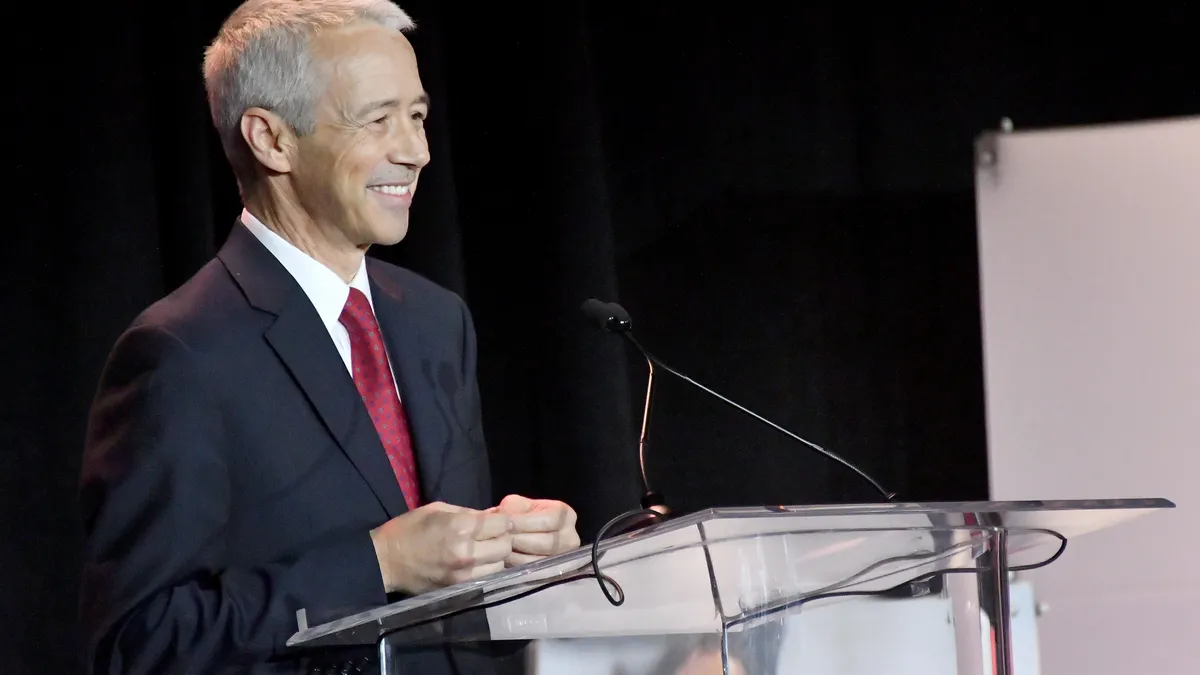

On a fourth-quarter and full-year earnings call this week, J&J CEO Joaquin Duato and CFO Joseph Wolk assured investors and analysts that despite these headwinds, the company's future looks bright as it’s ready to withstand pressures under which a smaller pharma company might stumble.

Here, we're highlighting some of the comments Duato and Wolk made during the call and exploring their level of optimism for where the pharma giant is headed in 2023 and beyond.

Lingering inflation

"I would say just given all the macroeconomic uncertainty (and) the geopolitical uncertainty, we thought this was the right approach at this point in time to come out with guidance in the ranges that we did. … If there are any elements of conservatism, I would say it probably resides in the fact that we're not assuming any deflationary relief as we go throughout the year. So we do think these costs will be at a higher level for some time."

Joseph Wolk

CFO, J&J

J&J's revenue forecast for the full year in 2023 takes into account inflationary pressure that's likely to continue, despite slowing in the second half of 2022. Still, the company expects to bring in between about $97 billion and $98 billion across all its businesses — last year, revenue was $94.9 billion.

Wolk said he is expecting carry-over of the inflationary impact seen in 2022 as a result of building inventory at a higher cost during the year. Some market watchers outside of the pharma industry expect a bigger decline in inflation as the year progresses, according to reports, but so far the markets have remained steady. And many are hoping the rapid fluctuations won't result in a recession.

For J&J, the size and diversity of its portfolio will help to weather the storm, and Wolk said the company is "doing everything (it) can to prioritize (its) top investments for the long term as well as manage costs in the interim."

Betting on multiple myeloma

"Our multiple myeloma portfolio is the most important driver of growth for our pharmaceutical group moving forward."

Joaquin Duato

CEO, J&J

Some Wall Street analysts have pointed out that the economic conditions could make it difficult for J&J's pharmaceutical division to bring in $60 billion in 2025, but Duato said that one of the "main disconnects between our forecasts and the Street forecast" is the company's growing multiple myeloma portfolio.

The multiple myeloma drug Darzalex was the one that started it all for J&J and brought in more than $2 billion in 2022. But the pharma giant brought two more treatments to the market this year — the cell therapy Carvykti and the bispecific antibody Tecvayli — and has another bispecific called talquetamab currently in the FDA’s hands.

Duato isn't afraid to tout lofty goals for the multiple myeloma franchise, aiming to "change the treatment paradigm" from treating the disease to finding a cure. The group of drugs could be used in combination and in certain sequences to make that happen for patients, he said.

Incoming biosimilars

"We expect the erosional curve of Stelara to be likely deeper than that of Remicade given the evolution of the biosimilar market and the fact that Stelara is a self-administered product, as well as potential interchangeability in the labels."

Joaquin Duato

CEO, J&J

Biosimilars are making a big splash in 2023 — just ask AbbVie, which is expecting nearly a new competitor every month this year for its bestselling arthritis and immunology drug Humira. J&J is also part of that conversation as its own blockbuster immunology treatment Stelara falls off the patent cliff. However, there are currently no approved biosimilars for Stelara, so the market dynamics are still somewhat in the air.

J&J has some practice in dealing with competition to a bestselling drug from when the cancer treatment Remicade experienced the same transition. Remicade has lost sales precipitously year to year. Duato also alluded to the maturation of the biosimilar market as the U.S. has promoted their approval and uptake as a means to lower drug prices.

But of course, J&J has other immunology drugs already on the market and in the R&D pipeline, including Tremfya, which is approaching blockbuster status, and an oral treatment in the IL-23 class that Duato called "a very exciting, under-appreciated opportunity in our pipeline."

Beating the market

"With respect to pharmaceuticals, we enjoyed our 11th consecutive year of above-market growth — we anticipate 2023 will be a 12th year, but it is off of a lower base."

Joseph Wolk

CFO, J&J

The J&J pharmaceuticals division has been on the upswing since 2012, and Wolk said that the company is on track to continue performing better than the overall U.S. market, even if that number is a little lower due to the economic slowdown.

Through those flush years, the company has placed a priority on dealmaking. In medtech, that included the large acquisition of Abiomed — and that was only the tip of the iceberg as J&J performed "more than 100 smaller early-stage acquisitions, licensing deals and partnerships," Wolk said.

While the pharmaceutical segment grows, J&J is also separating its consumer business into a new company called Kenvue to become a publicly traded entity by November. Executives have said that the spinoff will leave the remaining company to focus on innovation in a nimbler environment.