Welcome to today’s Biotech Spotlight, a series featuring companies that are creating breakthrough technologies and products. Today, we’re looking at InterVenn Biosciences, which developed what the company calls the “world’s first glycoproteomic, liquid-biopsy laboratory-developed test (LDT).”

In focus with: Aldo Carrascoso, the CEO and co-founder of InterVenn Biosciences

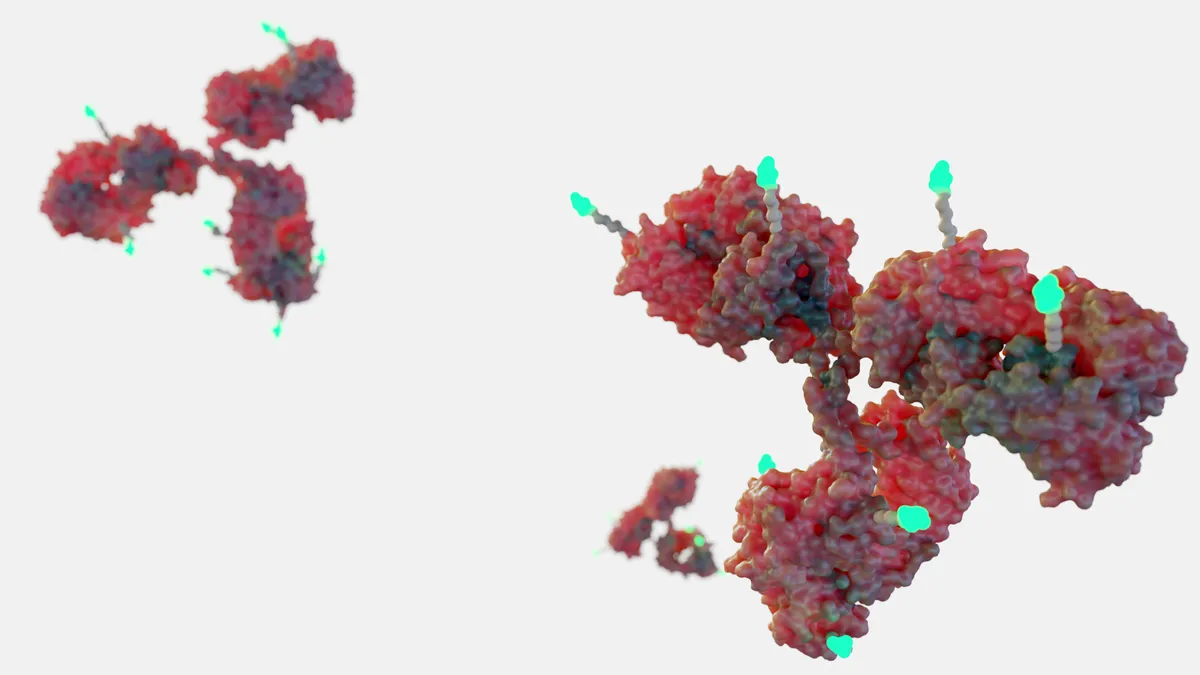

InterVenn’s breakthrough technology: A private-stage company, InterVenn has developed a “proprietary glycoproteomic biomarker discovery and interrogation platform based on AI-empowered mass spectrometry for next-gen precision medicine.” The diagnostic is based on glycosylation, which is essential for normal cell and organ functions, and is the process of attaching sugar molecules to a variety of biological materials such as proteins, lipids and even RNA. Glycosylation alterations have been associated with a variety of diseases, including cancer.

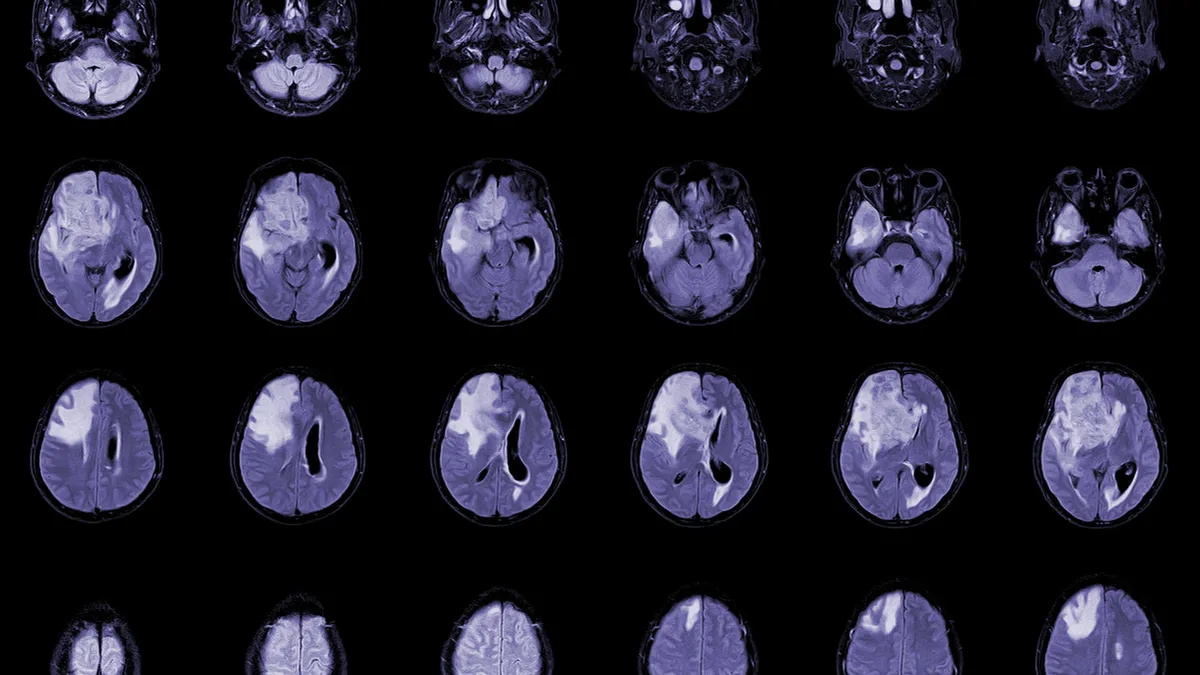

InterVenn is also aiming to develop novel predictive tests for a range of indications, including “ovarian, pancreatic, liver, prostate, lung, kidney and other cancers, as well as on tests for treatment response prediction and monitoring of treatment efficacy, and disease progression.”

Why it matters: Believing “no one should ever be blindsided by disease,” Carrascoso says the company is mission-driven to develop diagnostic solutions based on a unique, largely untapped layer of biology where the company enjoys the benefits of a “blue ocean” market and IP landscape.

According to MarketsandMarkets, “the global liquid biopsy market is projected to reach $5.8 billion by 2026 from $2.5 billion in 2021, a CAGR of 18.1% during the forecast period.” Analysts cite the rising incidence and prevalence of cancer and the increasing preference for noninvasive treatment procedures as key market drivers.

“We know the value of glycoproteomics and our perspectIV platform aims to develop powerful, clinically impactful blood-based diagnostics,” Carrascoso says. “Though current liquid biopsy technologies have great promise in identifying genomic drivers of disease, they present significant challenges that can be clinical adoption hurdles. Our perspectIV platform addresses the bulk of these challenges by circumventing the need for high sample input volumes. We need less than 100uL of peripheral blood — not relying on analytes shed by tumors, and reproducibly demonstrating strong diagnostic performance. Also, our vision is to democratize access to this platform through partnerships to enable the realization of precision medicine.”

At a glance: The company’s first product is Glori, an LDT for ovarian cancer diagnosis that has been validated using both retrospective patient samples and samples collected prospectively in InterVenn’s VOCAL clinical trial.

Next up in the company’s pipeline is Dawn, which InterVenn is bringing to the clinic with the goal of helping physicians make the best possible decisions when treating cancer patients with immuno-oncology (IO) therapies. According to InterVenn, there is a strong unmet medical need for tests that can guide selection of the appropriate IO treatment.

Here, Carrascoso talks about the current financing environment, the company’s technology, strategic priorities for the coming year and more.

PharmaVoice: What’s your take on the current biotech funding environment? What’s hot, what’s not?

Aldo Carrascoso: We’re focused on biomarkers and the application of diagnostics based on glycoproteins. We believe this is a largely unexplored field of biology that our technology has unlocked. As such, we are seeing a great deal of interest from biotechs and pharma in glycoprotein-based predictive biomarkers to stratify patients. Combined with pharma’s interest to continue to expand their repertoire of drug targets by investing in new drug chemistries and AI methods, we see a very optimistic outlook for novel biomarker technologies.

Our current investors and the investors with whom we have had the most engaging discussions are excited by InterVenn’s ability to leverage a single analytical workflow, and the high specificity of the biomarkers we identify to generate diagnostic content very efficiently, rapidly. We therefore have the ability to rapidly develop and deploy a pipeline of solutions based on this unique, and powerful -omic for our own commercial channel and/or that of our partners.

What are the most common questions investors ask?

The most common question we get is how do we compare with the myriad liquid biopsy and/or proteomics companies, and how do we plan to compete? The answer is we don’t really plan to. We see our platform, as well as the layer of biology we focus on, to be very complementary to the bulk of genomics and proteomics platforms. We see an increasing interest in integrative development approaches that look to combine glycoproteomics with other -omics methods. Rather than competitors, we see partners.

What are your key strategic initiatives in the next 12 months?

We’re excited to detail how we will meet our expected goals and milestones for the year in the form of the commercial launch of our Dawn assay for prediction of response to immune checkpoint inhibitors, clinical and health economic evidence in support of Dawn, announcements of strategic partnerships, and details of new entries to our product pipeline.