In the days long before migraine drugs, those with the condition were willing to try almost anything to get rid of the pain. They wrapped their heads in potato slices, rubbed their temples with a pungent salve of cow manure and molasses, and stuck bloodsucking leeches to their forehead.

It’s a desperation migraine sufferers understand. Chronic migraine, which affects more than 10% of people worldwide, isn’t just headaches but a neurological condition that triggers throbbing head pain that can last for days and can sometimes cause visual disturbances, brain fog, nausea and extreme sensitivity to light and sounds. The condition is a leading cause of disability in the U.S., particularly for women, who are disproportionately affected. In fact, three out of every four migraine sufferers are women.

Treatment options have come a long way since the days of folk remedies. The first migraine treatment, ergotamine came along in the 1920s, and a trickle of other drugs followed. However, the FDA approved the real game-changer in the early 1990s — GSK’s sumatriptan, sold under the brand-name Imitrex. It was the first in a crop of triptan drugs that provide rapid relief by tamping down nerve inflammation and constricting dilated blood vessels.

“Everything changed because of these,” said Dr. Seth Lederman, CEO of Tonix Pharmaceuticals, a company working in the migraine space.

Even today, sumatriptan remains the gold standard, he said. But the field took another leap forward in 2018 with the arrival of groundbreaking injectable or intravenous migraine prevention drugs called calcitonin gene-related peptide (CGRP) monoclonal antibodies. This category includes drugs such as Amgen’s Aimovig, Eli Lilly and Co.’s Emgality and AbbVie’s Ubrelvy and most recent Qulipta, which prevent headaches by reducing levels of CGRP, a protein that drives migraine symptoms.

A subcategory of related small molecule drugs called gepants followed. Most gepants, such as Pfizer's blockbuster Nurtec, are pills. Nurtec is the only drug in the category approved to both prevent and treat migraine pain. However, the newest addition, Zavzpret, is a nasal spray that Pfizer acquired from Biohaven Pharmaceuticals along with Nurtec in a transaction that was worth $11.6 billion. The FDA signed off on the drug in March for acute relief, but it’s still in phase 2/3 for migraine prevention.

These new drugs have advantages over existing migraine meds.

“The standard of care treatment options for migraine, while effective, do have many limitations, including tolerability issues, contraindications for cardiovascular disease, the need for repeat dosing and the risk of developing medication overuse headache, which exacerbates migraine and increases the frequency and severity of attacks,” a Pfizer spokesperson said.

CGRP and gepants can work where other drugs have failed and help those who can’t take other migraine treatments. These options carry a lower risk of rebound headaches and other side effects and have a solid safety profile, which has helped them fuel a global migraine market expected to reach $15.6 billion by 2029.

However, while CGRP drugs have offered new options, they’re not a panacea. They typically reduce the average number of monthly headache days from around 15 to 12, leaving room for improvement, Lederman said.

“Even with the CGRP blockers and now the gepants, migraine is not solved,” he said.

Several companies are working on novel treatments and trying new takes on old treatments to bring more relief.

Examining the pipeline

In 2022, PhRMA listed 13 migraine medications in development. Since then, at least two have failed, including a phase 2 Eli Lilly drug, LY3451838, for treatment-resistant migraine and a transdermal patch from Zosano Pharmaceuticals, which declared bankruptcy and sold its technology to Emergex Vaccines.

“Even with the CGRP blockers and now the gepants, migraine is not solved.”

Dr. Seth Lederman

CEO, Tonix Pharmaceuticals

Of those that remain, there are a few testing novel mechanisms, including Tonix’s TNX-1900, an oxytocin-based drug now in phase 2 as a migraine preventative, and Lundbeck’s monoclonal antibody Lu AG09222 targeting a neuropeptide called pituitary adenylate cyclase-activating polypeptide, which also plays a role in migraine, Lederman said. Others are a mix of CGRP drugs and new combinations and formulations of existing drugs.

AEON Biopharma is exploring a new take on the neurotoxins, such as Botox and Dysport, used to prevent chronic migraine with its phase 2 drug ABP-450, a 900 kDa botulinum toxin type-A complex. In 2010 the FDA approved neurotoxins, which are injected at multiple points in the head and neck to reduce migraine frequency, potentially by interrupting pain signals. The new formulation from AEON aims to treat people with both chronic migraine and those with fewer than 15 headaches a month and it requires fewer shots — 22 versus 31 — than standard neurotoxins.

Satsuma Pharmaceuticals wants to improve on the long-time migraine drug dihydroergotamine (DHE) with STS101, which delivers it as a nasal powder. DHE, a derivative of ergotamine developed in the 1940s, is also used by Impel Pharmaceuticals in its nasal spray, Trudhesa, approved by the FDA in 2021.

Also in the pipeline is Charleston Laboratories' drug to treat migraine pain and nausea, CL-H1T, a combination of sumatriptan and promethazine, which is used to treat allergies and nausea.

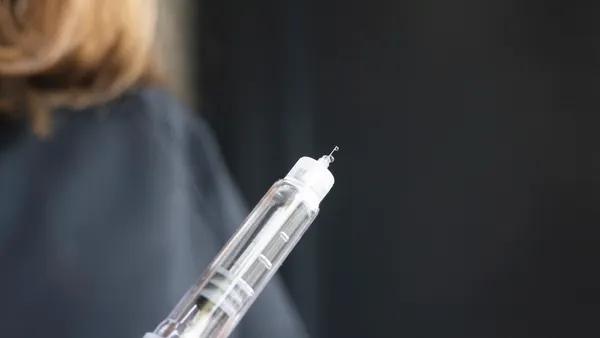

Triptans are also still playing a starring role in migraine treatment. In July, Tonix announced the acquisition of two approved sumatriptan formulations from Upsher-Smith Laboratories — a nasal spray, Tosymra, and an injectable, Zembrace SymTouch, which generated $23 million in 2022. Sumatriptan’s nasal spray and injectable formulations are not new, but they’ve never really taken off.

“Americans preferred pills,” Lederman said, adding that the market may now be ripe for these drugs, which provide rapid relief and are more tolerable for people experiencing migraine-related nausea.

While there’s still no cure for migraine, new treatments are slowly chipping away at the problem, bringing forth new options for people with the condition. Pfizer predicts that CGRP options, in particular, will continue to expand.

“Due to the safety and efficacy demonstrated by CGRP receptor antagonists, we anticipate continued growth in this class of medicines. Our hope is that there will be improvements in screening and diagnosis of migraine, so that many more patients can benefit from individualized treatment options to manage this disease,” a Pfizer spokesperson said.