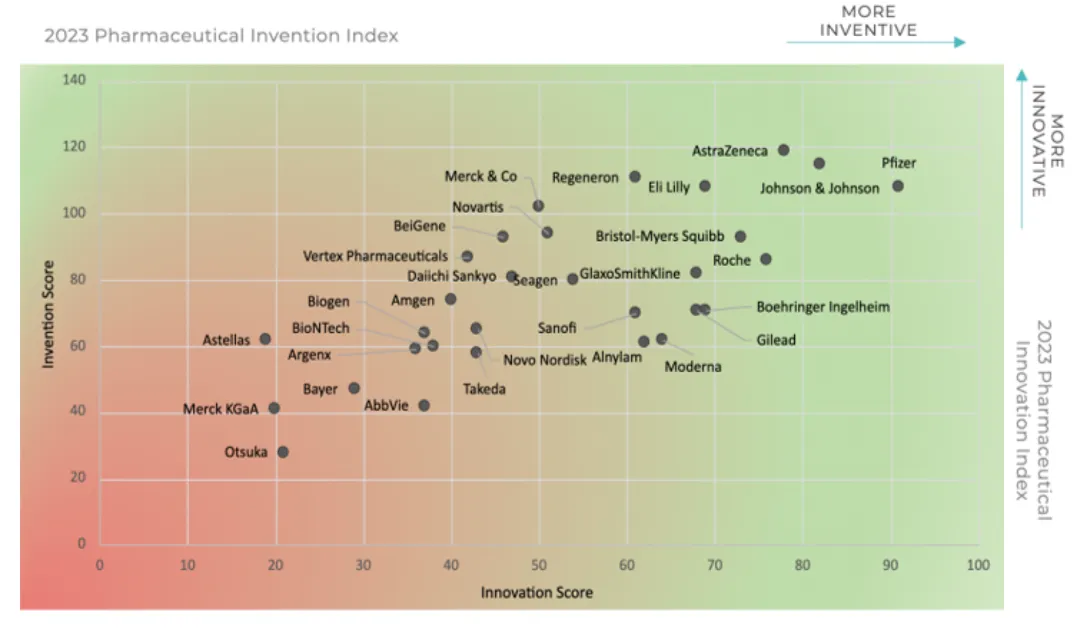

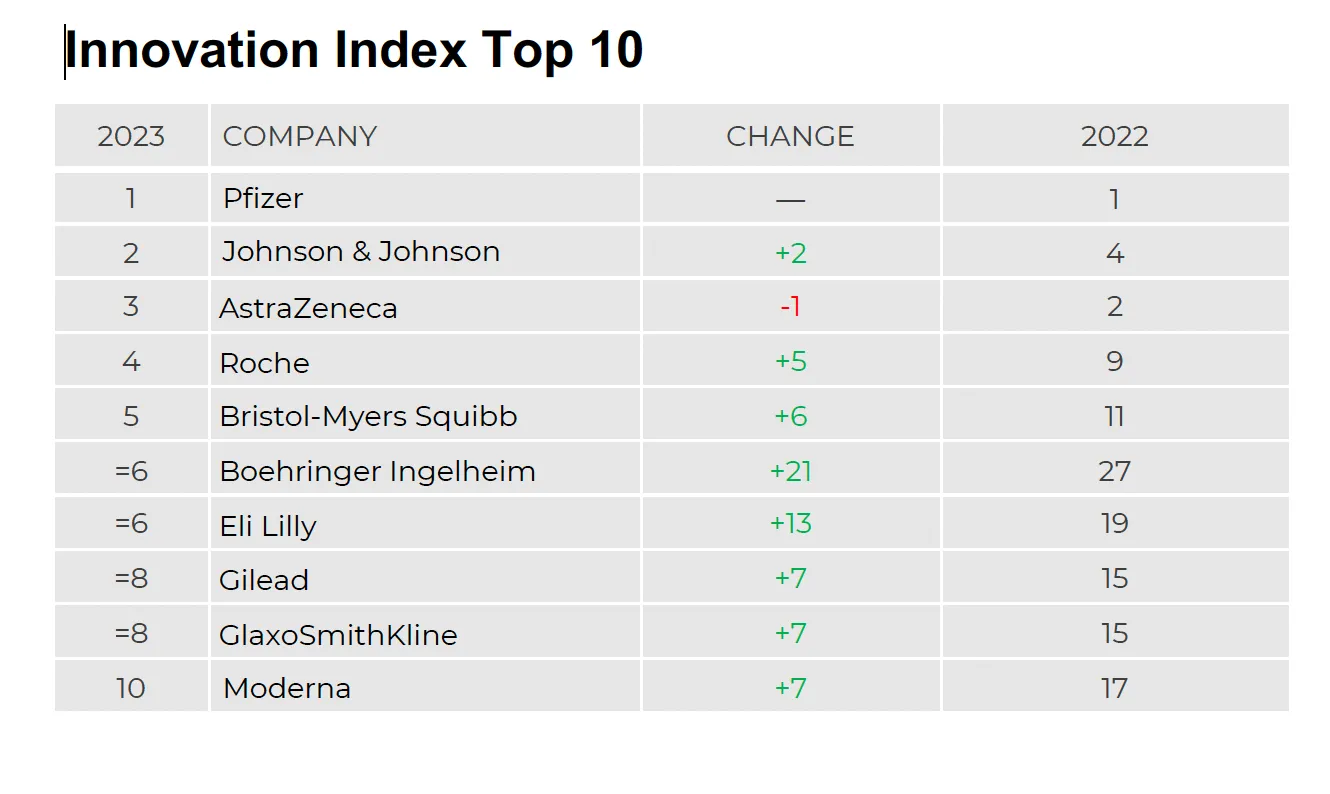

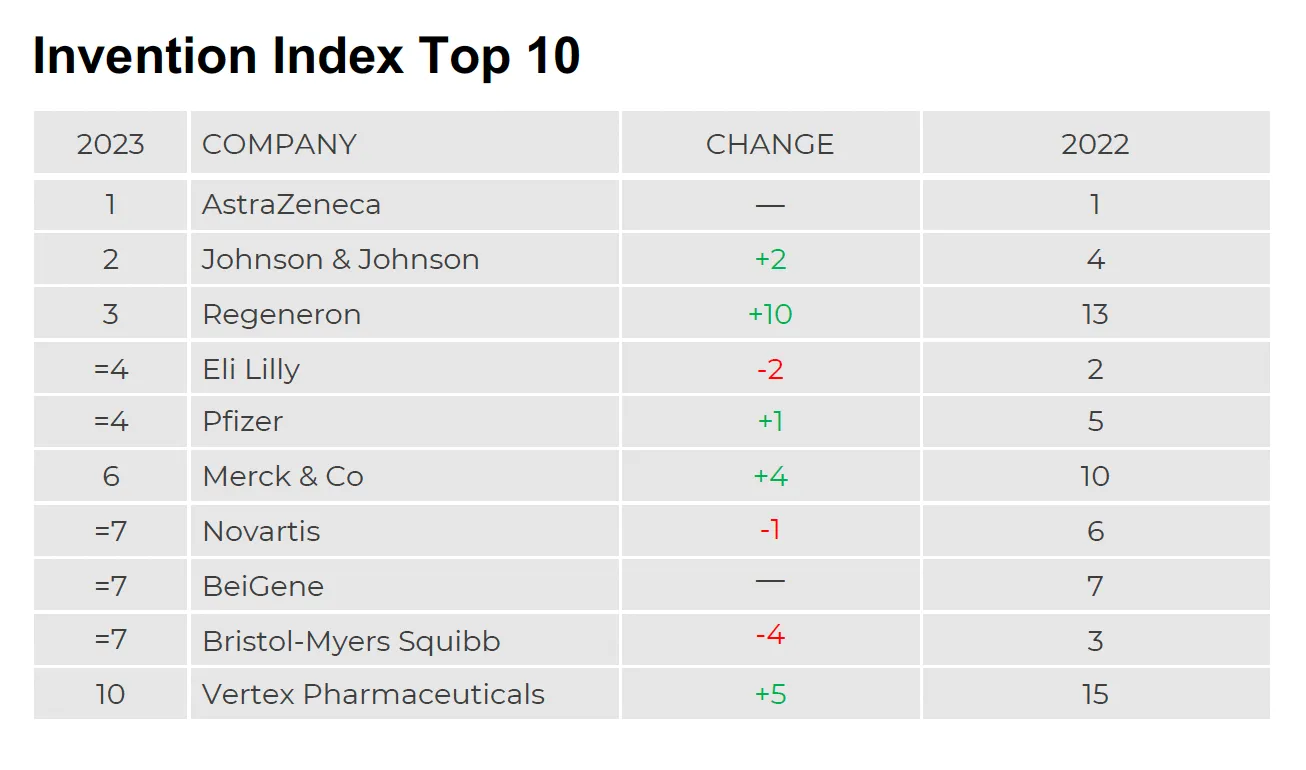

For the second year in a row, Pfizer claimed the coveted No. 1 spot on IDEA Pharma’s Innovation Index while AstraZeneca retained its No. 1 position on the Invention Index.

A dozen years ago, Mike Rea, CEO and founder of IDEA Pharma, endeavored to understand why some companies are better at launching their pipelines than others and asked: If two pharma companies were given the same molecule in early phase, which of the two would be better at developing and launching it?

Now, IDEA Pharma’s analysts dig into publicly available clinical, regulatory and commercial data of the top 30 pharma companies every year to assess their productivity and effectiveness. To evaluate the top inventors, IDEA examines the pipelines of the top 30 pharma companies, looking for novel medicines being driven by scientific breakthroughs.

Pfizer’s No. 1 ranking, according to IDEA, is based on its COVID-19 portfolio, as well as eight product approvals in 2022, including an approval by the European Medicines Agency for Vydura, the first medicine given the nod for both acute and prophylactic treatment of migraine and the FDA approval of Cibinqo for moderate-to-severe eczema. Pfizer also notched four 2022 acquisitions — Arena Pharmaceuticals, Biohaven Pharmaceuticals, Global Blood Therapeutics and ReViral — which are expected to bolster the Big Pharma’s pipeline, product portfolios and revenue stream — from $5 billion to $30 billion by 2030.

For its No. 1 spot on the Invention Index, AstraZeneca was lauded not just for its burgeoning pipeline of almost 180 projects — 155 of which are in the clinic — but for its potential to significantly impact disease areas and patient populations with unmet needs. IDEA analysts also noted that while it’s still early in terms of understanding the long game, AZ’s investment in AI-enabled drug discovery is among the highest in the industry.

“On one side we look at the R&D investment and how efficient and effective companies are, and on the other side, we look at how successful they are with realizing innovation in terms of creating meaningful value from their inventions,” said Jacqueline Barendregt, chief operating officer of IDEA Pharma.

Barendregt also noted that invention — developing new drugs — does not always directly lead to innovation — created value from those products.

“One thing that stood out when we looked at two of the top pharma organizations, Pfizer and Novartis, which ranked No. 7 on the Innovation Index, is that we can see that they’re almost equally effective and efficient in their R&D spend. They are up almost 20% in terms of developing drugs from phase 1 to getting regulatory approval,” Barendregt said. “However, if we then look at the revenue generated from new products, Pfizer is at 60% which correlates with $61 billion coming from products launched in the last three to five years. Whereas, Novartis has less than 10% of its revenue coming from products launched in the last three to five years.”

Part of this discrepancy, Barendregt noted, has to do with the types of therapies the companies have been developing.

“A major growth driver for Pfizer in 2022 was the COVID products — the company achieved more than $100 billion in revenue, a record in its history. But at Novartis, which had the highest number of approvals — 14 last year — and focused on innovative platforms like RNA and cell and gene therapies, this creates a different environment for development,” Barendregt pointed out. “The products are indicated for small patient populations, which are unlikely to yield large revenue streams. This demonstrates that connection between invention and innovation and that efficiency is good, but efficiency without effectiveness is, in the long run, not sustainable.”

Here, Barendregt shares further insights into the 2023 indices including the surprises, dark horses and the volatility of the rankings.

This interview has been edited for brevity and style.

PHARMAVOICE: Pfizer was at the top of the rankings again this year, what specifically gives it an edge in terms of its R&D philosophy?

JACQUELINE BARENDREGT: When we looked specifically at Pfizer, what it does well is how it leverages data. Pfizer uses system partners to generate unique insights. And those unique insights are from a disease perspective to understand what quality of life means for a specific patient population and what are some of the challenges that they experience along their care journey in terms of the different standards of care. Pfizer also looks at the payer and prescriber mix. This data input is used to build a holistic view as to the different elements of value when it comes to developing their medicines. And the company starts early — it’s not an afterthought going into launch when they think about the patient as the most important stakeholder in all of this. It’s really from the R&D perspective. I think this is something that sets them apart.

Looking at AstraZeneca and its pipeline, do you think it has the capacity to take over the No. 1 spot on the Innovation Index?

Definitely. AstraZeneca is a company that’s been steadily climbing the ranks in the past few years. Obviously, they have an enormous pipeline with hundreds of projects in development across oncology as well as cardiovascular, renal and metabolic diseases. They’ve acquired Alexion to also focus on the rare disease population, high unmet medical needs, and cell and gene therapy platforms. So, AZ doesn’t shy away from challenges. We also see a focus on disease areas with high unmet needs, which has been credited in the Invention Index. Yes, they’re well set up to take the No. 1 spot on the innovation side as well.

Do you have your eye on some dark horses? What companies should we be looking at in the next couple of years?

With the Invention Index, we look to those companies discovering new therapeutics and breakthrough therapies for high medical unmet needs. To give you another example of a company that’s been successful in that area and in terms of the commercialization approach is Boehringer Ingelheim, which jumped from No. 27 on last year’s index all the way up to No. 6. It had the first-ever approval for a small, rare orphan indication (spesolimab for generalized pustular psoriasis). It also has a successful portfolio of marketed products. That shows it can successfully turn inventions into innovations. And with the approval of the IL-36 inhibitor, there’s a whole pipeline of other indications coming. BI is looking to maximize the potential of this molecule for different patient populations.

I think Novo Nordisk is another company to watch; it’s been looking to diversify its portfolio and go beyond being a diabetes company to one that also treats obesity, NASH and other metabolic diseases. It’s obviously quite successful with its GLP-1 franchise. One of the other very exciting therapy areas it’s looking to break into is Alzheimer’s disease. And we know that’s still, you could say, a graveyard of failures and it’s challenging to make products accessible and affordable in the market. But, there is also an opportunity and I think if Novo Nordisk is successful in realizing all that ambition, we could see it jumping up as we’ve seen for instance with Boehringer.

There seemed to be a lot of volatility on the index this year. What do you attribute that to?

That’s partly due to the companies that did well during the COVID pandemic and that’s definitely reflected in the portfolio. But what we’ve also seen, which might have been also a result of the COVID pandemic, there was a bit of a slowdown in deals toward the end of 2021, early 2022. But that’s picked up again toward the second half of last year.

We also see that clinical development is becoming more refined within the industry — it’s more targeted. We’ve seen fewer companies applying a traditional one-size-fits-all approach. So, the shots on goal within the industry are becoming more effective.

That’s really good news. Do you attribute that to new ways of thinking?

Yes, new kinds of thinking. Also, there are companies like Alnylam for instance, which entered the index this year for the first time. It’s a company that had a history of 20 years of setting the stage of bringing a product to the market with a lot of learnings and gaining an understanding of what creates value. The mode of administration is important for people who need to take the therapy. Effectiveness and safety of course are those parameters. But we always ask, what does efficacy mean? What is the next frontier of value in specific disease areas? And those questions have been incorporated in drug development.

Do you think IDEA Pharma has changed the R&D conversation?

I would say yes. In terms of our view and approach, it’s obviously important to know what the molecule can do. But if companies really want to realize value from their invention, they need to think about what the market might need and want. That requires teams to bring the highest levels of knowledge and creative thinking to the table.

Also, leadership in pharma organizations get presented better options rather than just one option. The idea is to bring a portfolio of options and to keep those options alive as long as possible. I think there’s still more work ahead because at the moment teams are not necessarily incentivized for keeping more options alive. They’re being incentivized for phase transition and the success rate of assets moving through development, which colors views about giving assets a favorable ranking based on certainty.

We say this is like a person who’s searching for their keys under the lamp post because that’s where the light is. But quite often, the opportunity lies in the dark and that’s where you need to explore and then find ways to generate the evidence that will help you to build a more certain profile.